Top Industry Leaders in the Tokenization Market

Tokenization Market: Dive into the Latest News and Updates

Data security is the crown jewel of the digital age, and tokenization has emerged as a knight in shining armor, safeguarding sensitive information by transforming it into unreadable tokens. The Tokenization Market, where these digital shields are forged, is experiencing explosive growth, fueled by rising cyber threats and stringent data privacy regulations.

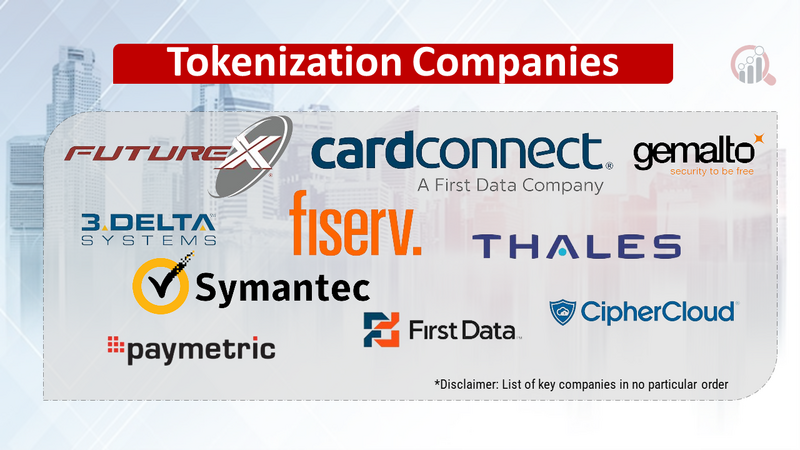

Some of Tokenization Companies Listed Below:

- Symantec Corporation (US)

- Gemalto NV (Netherlands)

- Fiserv Inc (US)

- Paymetric Inc (US)

- First Data Corporation (US)

- CipherCloud (US)

- Futurex (US)

- CardConnect Corp. (US)

- 3Delta Systems Inc (US)

- Thales e-Security Inc (US)

Strategies Fueling Growth:

- Security and Compliance Focus: Providing robust encryption algorithms, secure key management systems, and compliance with data privacy regulations like GDPR and CCPA builds trust and opens doors to industries with stringent data protection requirements.

- Ease of Integration and Deployment: Seamless integration with existing IT infrastructure, cloud platforms, and data protection tools simplifies adoption and accelerates security implementation.

- Industry-Specific Solutions: Developing pre-configured tokenization solutions tailored to specific industries like healthcare, finance, and government, addresses the unique data security challenges of each sector.

- Scalability and Flexibility: Ability to handle large volumes of sensitive data, support diverse data types, and adapt to evolving regulatory landscapes attracts organizations with complex data management needs.

Market Share Decoding: Key Factors to Consider

- Functionality and Feature Set: Platforms offering a comprehensive range of tokenization algorithms, key management options, compliance features, and data integration capabilities hold an edge in catering to diverse security needs.

- Pricing and Deployment Options: Competitive pricing models, flexible subscription plans, and cloud-based or on-premise deployment options cater to diverse budget constraints and IT environments.

- Ease of Use and Support: Offering user-friendly interfaces, extensive documentation, and responsive technical support empowers users and lowers barriers to adoption.

- Reputation and Track Record: A proven track record of successful tokenization implementations and strong security expertise builds trust and attracts risk-averse organizations.

New and Emerging Stars: Illuminating the Data Security Path

- Quantum-Resistant Tokenization: Companies like PQShield and Entrust Quantum Crypto are developing tokenization solutions resistant to attacks from future quantum computers, safeguarding data for the long term.

- Blockchain-Based Tokenization: Startups like Polymath and Harbor Platform are leveraging blockchain technology for tokenized asset management, offering enhanced security, transparency, and fractional ownership models.

- Data Privacy Enhancing Technology (DPET): Companies like Anonymizing.io and Immuta are developing DPET solutions like homomorphic encryption and federated learning, allowing data analysis without revealing the underlying sensitive data.

Investment Trends: Where the Security Dollars Flow

- AI and Machine Learning Integration: Investors are backing companies developing AI-powered features for data breach detection, anomaly identification, and automated tokenization workflows, enhancing security automation.

- Cloud-Native Tokenization Solutions: With the shift towards cloud adoption, investments are pouring into cloud-based tokenization platforms designed for scalability, ease of deployment, and seamless integration with cloud ecosystems.

- Focus on Compliance and Regulatory Landscape: Mergers and acquisitions between tokenization providers and compliance management companies are accelerating market consolidation and driving expertise in navigating complex data privacy regulations.

- Emerging Technology Integration: Investments are surging in companies applying quantum-resistant cryptography, blockchain technology, and DPET solutions to tokenization, offering future-proof and secure data protection.

Latest Company Updates:

- Jan 2024: The US Securities and Exchange Commission (SEC) approves the first-ever exchange-traded fund (ETF) based on a tokenized basket of securities.

- Dec 2023: Governments are actively developing regulations for tokenized assets, creating both opportunities and challenges.

- Dec 2023: Mastercard partners with IBM to develop a blockchain-based platform for tokenizing real estate assets.

- Nov 2023: Tokenization is moving beyond securities and into real estate, art, music, and other asset classes.