Research Methodology on Tokenization Market

1. Introduction

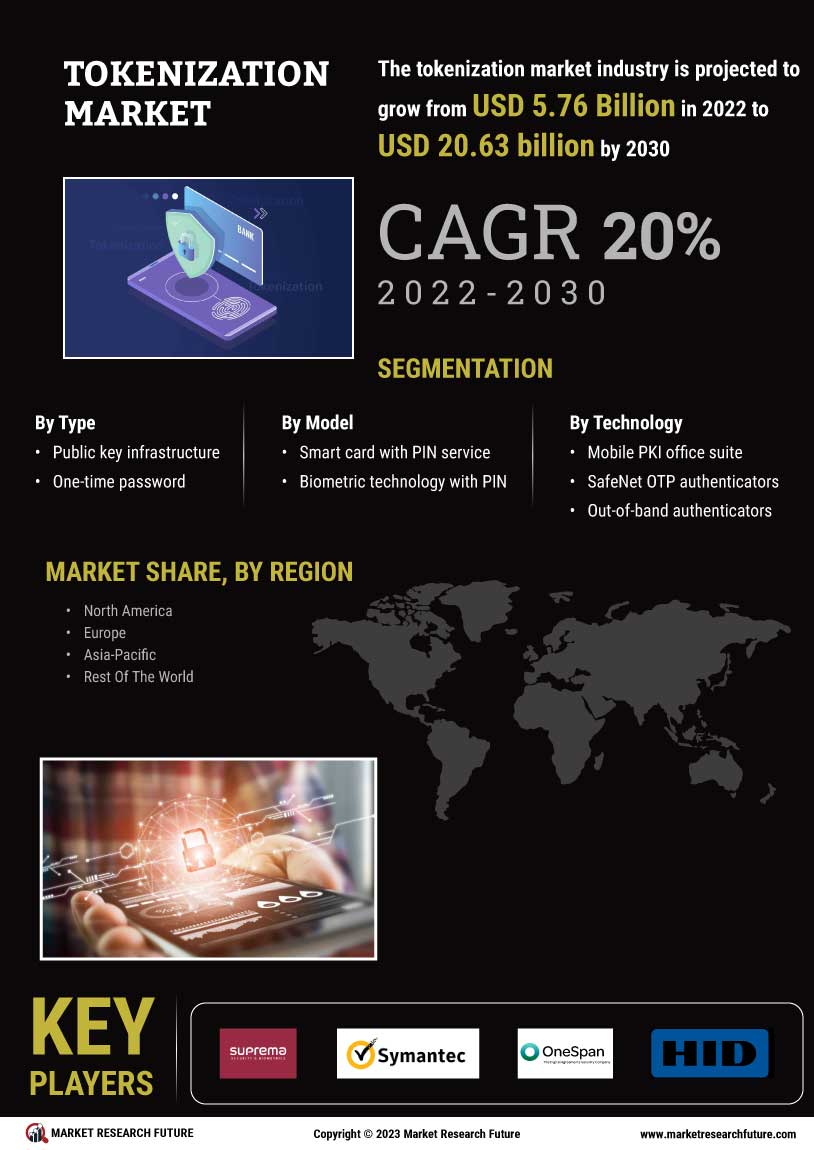

Tokenization is the process of substituting sensitive data with a token that is only meaningful to the system generating and using it, such as a payment card number, social security number, bank account details, etc. Tokenization is one of the best methods of data security, as it encrypts the number, name and address of data sent to the payment gateway while providing superior security against data thefts or violations. This method is not only used in payment processing but also in other systems, web authentication, web services accounting, call centre applications and online banking. The global tokenization market is estimated to expand at an exponential CAGR during the forecast period from 2023 to 2030.

2. Objective

The objective of this research project is to analyze the impact of various factors on the growth and development of the global tokenization market during the forecast period of 2023-2030. The major factors that are taken into consideration while conducting this research are the increasing demand for data security, the increasing usage of cloud-based technology, the growing usage of mobile and e-wallets, the growth of competition in the finance sector and the changing regulations in different countries with regards to data protection.

3. Research Methods

For the research of this project, both secondary as well as primary methods are employed. The secondary research involves the collection of data from different market reports and industry journals which focus on the tokenization market. This data is used to gain insights into past and current market trends, the competitive landscape, and the regional and global performance of the tokenization market. The primary research involves conducting online interviews with market experts and opinion leaders in the blockchain and payments industries to gain their opinion on the future prospects of the tokenization market.

4. Research Design

For the research of this project, a qualitative exploratory research design is employed. This design is used to understand the various nuances and factors that influence the growth and development of the tokenization market. The research design is laid out in such a way as to provide a comprehensive understanding of the market, its dynamics and factors, with a critical analysis of the data by experts and industry players.

5. Sampling

Non-probability sampling technique is used in this research project. The population considered in this research project are the players in the tokenization market and the experts and industry players who know and have insights into the market. The said population is selected based on the convenience of the researcher and the availability of the required data.

6. Data Collection

For the research project, both qualitative as well as quantitative methods of data collection are employed. The primary data for the project is collected through online interviews with experts and industry players. The secondary data is collected from different industry publications and journals, trade magazines, reports, websites and other sources.

7. Data Analysis

The data collected for the research project is analyzed and interpreted using various statistical and analytical methods, such as quantitative analysis, trend analysis, market segmentation, etc. The analysis of the data is done to understand the key drivers and restraints, the market structure and dynamics, and the future prospects of the tokenization market.