E-commerce Growth

The US ready meals market is witnessing a significant transformation due to the rapid growth of e-commerce platforms. With the rise of online grocery shopping, consumers are increasingly turning to digital channels to purchase ready meals. Data suggests that online sales of ready meals have grown by over 30% in the past year, as consumers appreciate the convenience of home delivery and the ability to browse a wider selection of products. This trend is particularly appealing to younger demographics, who are more comfortable with technology and prefer the ease of online shopping. Retailers are responding by enhancing their online presence and offering exclusive deals on ready meals, further driving sales. As e-commerce continues to expand, it is likely to play a pivotal role in shaping the future of the US ready meals market.

Health and Wellness Trends

The US ready meals market is increasingly influenced by the growing health and wellness trends among consumers. There is a notable shift towards healthier eating habits, with many individuals seeking meals that are not only convenient but also nutritious. Recent surveys indicate that nearly 70% of consumers are more inclined to purchase ready meals that are labeled as organic, low-calorie, or high in protein. This demand has prompted manufacturers to reformulate their products, incorporating wholesome ingredients and transparent labeling practices. Additionally, the rise of health-conscious eating is reflected in the increasing availability of ready meals that cater to specific dietary needs, such as keto or paleo diets. As the focus on health continues to intensify, the US ready meals market is likely to adapt by expanding its offerings to meet these evolving consumer preferences.

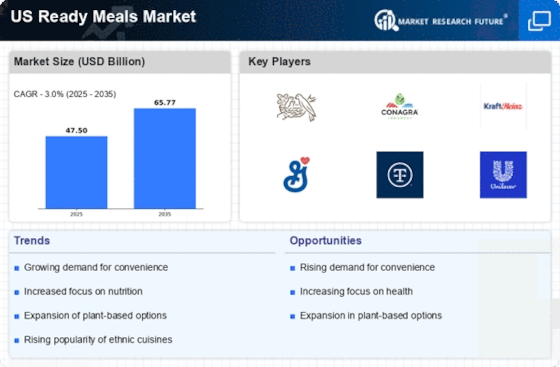

Convenience and Time-Saving

The US ready meals market is experiencing a surge in demand driven by the increasing need for convenience among consumers. Busy lifestyles, characterized by long working hours and family commitments, have led to a preference for quick meal solutions. According to recent data, approximately 60% of American households report that they regularly purchase ready meals to save time on meal preparation. This trend is particularly pronounced among millennials and working parents, who prioritize efficiency without compromising on taste. As a result, manufacturers are innovating to offer a variety of ready meals that cater to diverse dietary preferences, including vegetarian and gluten-free options. The convenience factor is likely to remain a key driver in the US ready meals market, as consumers continue to seek out products that fit seamlessly into their hectic schedules.

Diverse Culinary Preferences

The US ready meals market is characterized by an increasing diversity in culinary preferences, reflecting the multicultural fabric of American society. Consumers are seeking ready meals that offer authentic flavors and ingredients from various global cuisines. Recent market analysis shows that ethnic ready meals, including Asian, Mexican, and Mediterranean options, have seen a notable rise in popularity, with sales increasing by approximately 25% over the past year. This trend is driven by adventurous eaters who are eager to explore new tastes and experiences. Manufacturers are responding by expanding their product lines to include a wider array of international dishes, catering to the growing demand for variety. As the US population continues to diversify, the ready meals market is likely to evolve further, embracing a broader spectrum of culinary influences.

Sustainability and Ethical Sourcing

The US ready meals market is increasingly shaped by consumer demand for sustainability and ethical sourcing practices. As awareness of environmental issues grows, consumers are more inclined to support brands that prioritize eco-friendly packaging and responsibly sourced ingredients. Recent studies indicate that nearly 50% of consumers are willing to pay a premium for ready meals that are marketed as sustainable. This trend has prompted manufacturers to adopt greener practices, such as reducing plastic waste and sourcing ingredients from local farms. Additionally, transparency in sourcing is becoming a critical factor, with consumers seeking information about the origins of their food. As sustainability becomes a core value for many consumers, the US ready meals market is likely to see continued innovation in this area, as brands strive to align with these evolving expectations.