Automotive Sector Growth

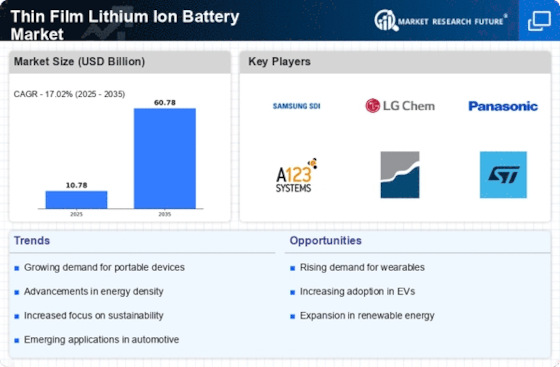

The Thin Film Lithium Ion Battery Market is also benefiting from the growth of the automotive sector, particularly with the rise of electric vehicles (EVs). As automakers strive to enhance vehicle performance and reduce emissions, the demand for lightweight and efficient battery solutions is escalating. Thin film batteries, with their potential for high energy density and rapid charging capabilities, are becoming an attractive option for EV manufacturers. Recent projections indicate that the electric vehicle market could expand at a CAGR of over 25% in the coming years, which may significantly boost the demand for thin film batteries. This trend suggests that the automotive industry's shift towards electrification will play a crucial role in shaping the future of the thin film lithium ion battery market, as manufacturers seek to innovate and meet the evolving needs of consumers.

Consumer Electronics Demand

The Thin Film Lithium Ion Battery Market is significantly driven by the rising demand for consumer electronics. As smartphones, tablets, and laptops continue to evolve, the need for efficient and compact battery solutions becomes critical. Thin film batteries offer advantages such as reduced size and weight, making them ideal for modern electronic devices that prioritize portability and performance. The consumer electronics sector is projected to account for a substantial share of the thin film battery market, with estimates suggesting it could represent over 40% of total market revenue by 2026. This trend indicates a strong correlation between advancements in consumer technology and the growth of the thin film battery market, as manufacturers seek to meet the increasing expectations of consumers for longer-lasting and faster-charging devices.

Integration with Emerging Technologies

The Thin Film Lithium Ion Battery Market is poised for growth due to its integration with emerging technologies such as wearable devices, Internet of Things (IoT), and electric vehicles. As these technologies proliferate, the demand for compact and efficient energy storage solutions becomes paramount. Thin film batteries, known for their lightweight and flexible characteristics, are particularly well-suited for applications in wearables and portable electronics. The rise of smart devices and connected technologies is expected to drive the need for advanced battery solutions that can support longer usage times and faster charging. Market analysts predict that the adoption of thin film batteries in these sectors could lead to a market expansion of approximately 15% annually, reflecting the increasing reliance on innovative energy storage solutions.

Technological Advancements in Battery Design

The Thin Film Lithium Ion Battery Market is experiencing a surge in technological advancements that enhance battery performance and efficiency. Innovations in materials science, such as the development of new electrode materials, are leading to batteries with higher energy densities and faster charging capabilities. For instance, the introduction of nanostructured materials has shown potential in improving the overall lifespan of batteries. As a result, manufacturers are increasingly investing in research and development to create thinner, lighter, and more efficient batteries. This trend is expected to drive the market forward, as consumers and industries alike seek more reliable energy storage solutions. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 20% over the next five years, indicating a robust demand for advanced battery technologies.

Sustainability and Environmental Considerations

The Thin Film Lithium Ion Battery Market is increasingly influenced by sustainability and environmental considerations. As the world shifts towards greener technologies, the demand for eco-friendly battery solutions is on the rise. Thin film batteries, which often utilize less toxic materials and have a smaller environmental footprint compared to traditional batteries, are becoming more appealing to manufacturers and consumers. Furthermore, the recycling potential of these batteries is gaining attention, as it aligns with global efforts to reduce waste and promote circular economies. This growing emphasis on sustainability is likely to propel the market, as companies that prioritize environmentally friendly practices may gain a competitive edge. Recent studies indicate that the market for sustainable battery technologies could reach a valuation of over 10 billion dollars by 2027, underscoring the importance of eco-conscious innovations.