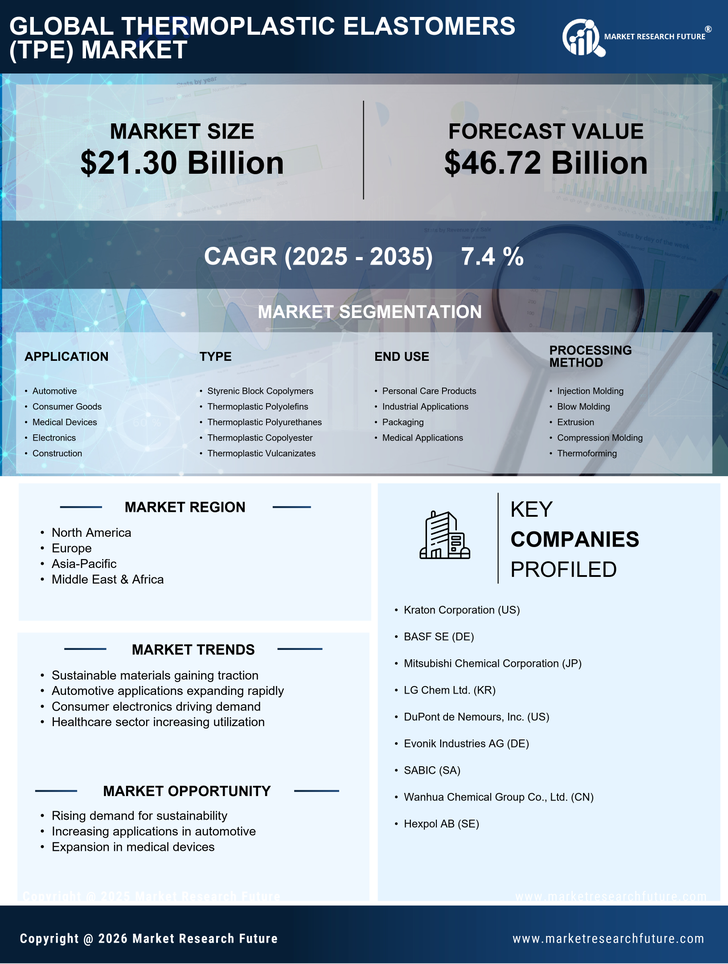

Thermoplastic Elastomers Market Summary

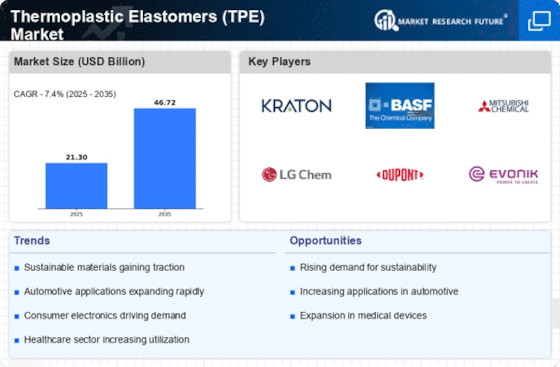

As per Market Research Future analysis, the Thermoplastic Elastomers Market Size was estimated at 21.3 USD Billion in 2024. The TPE industry is projected to grow from 22.88 USD Billion in 2025 to 46.72 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 7.4% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Thermoplastic Elastomers Market is poised for robust growth driven by sustainability and technological advancements.

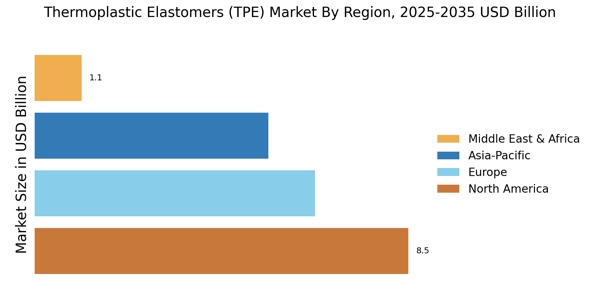

- North America remains the largest market for TPE, reflecting a strong demand across various industries.

- The Asia-Pacific region is emerging as the fastest-growing market, fueled by rapid industrialization and urbanization.

- The automotive segment continues to dominate TPE consumption, while the medical devices segment is witnessing the highest growth rate.

- Sustainability initiatives and technological innovations are key drivers propelling the TPE market forward.

Market Size & Forecast

| 2024 Market Size | 21.3 (USD Billion) |

| 2035 Market Size | 46.72 (USD Billion) |

| CAGR (2025 - 2035) | 7.4% |

Major Players

Kraton Corporation (US), BASF SE (DE), Mitsubishi Chemical Corporation (JP), LG Chem Ltd. (KR), DuPont de Nemours, Inc. (US), Evonik Industries AG (DE), SABIC (SA), Wanhua Chemical Group Co., Ltd. (CN), Hexpol AB (SE)