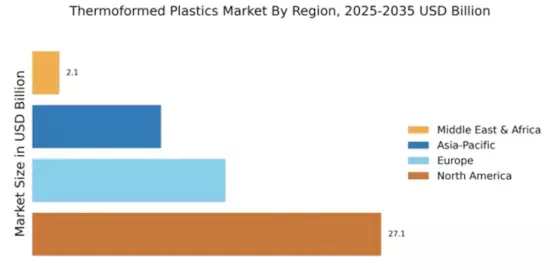

North America : Market Leader in Thermoforming

North America is poised to maintain its leadership in the thermoformed plastics market, holding a significant share of 27.1% in 2024. The region's growth is driven by increasing demand in sectors such as food packaging, medical devices, and consumer goods. Regulatory support for sustainable materials and innovations in manufacturing processes further catalyze market expansion. The focus on reducing plastic waste and enhancing recyclability is also shaping demand trends. The competitive landscape in North America is robust, featuring key players like Sonoco Products Company, Pactiv Evergreen Inc., and Berry Global Inc. The U.S. stands out as the leading country, supported by advanced manufacturing capabilities and a strong emphasis on R&D. The presence of major companies fosters innovation and drives market growth, ensuring that North America remains at the forefront of the thermoformed plastics industry.

Europe : Emerging Sustainability Focus

Europe's thermoformed plastics market is projected to grow, capturing a market size of €15.0 million by 2025. The region is increasingly focusing on sustainability, driven by stringent regulations aimed at reducing plastic waste and promoting recycling. The European Union's directives on single-use plastics and packaging waste are significant catalysts for market growth. Additionally, the demand for eco-friendly packaging solutions is rising, aligning with consumer preferences for sustainable products. Leading countries in this region include Germany, France, and the UK, where companies like Greiner Packaging International and Amcor plc are making significant strides. The competitive landscape is characterized by innovation in biodegradable materials and advanced manufacturing techniques. The presence of established players and a strong regulatory framework positions Europe as a key player in The Thermoformed Plastics.

Asia-Pacific : Rapid Growth Potential

The Asia-Pacific region is witnessing rapid growth in the thermoformed plastics market, with a projected size of $10.0 million by 2025. This growth is fueled by increasing industrialization, urbanization, and rising disposable incomes, leading to higher demand for packaged goods. Additionally, government initiatives promoting manufacturing and investment in infrastructure are significant growth drivers. The region's focus on enhancing production efficiency and sustainability is also shaping market dynamics. Key players in Asia-Pacific include Amcor plc and Sealed Air Corporation, with countries like China and India leading the charge. The competitive landscape is evolving, with local manufacturers emerging alongside established global players. The region's diverse market needs and growing consumer base present ample opportunities for innovation and expansion in the thermoformed plastics sector.

Middle East and Africa : Emerging Market Dynamics

The Middle East and Africa (MEA) region is gradually emerging in the thermoformed plastics market, with a market size of $2.1 million anticipated by 2025. The growth is driven by increasing demand in sectors such as food and beverage packaging, healthcare, and consumer products. The region's economic diversification efforts and investments in manufacturing capabilities are also contributing to market expansion. Regulatory frameworks are evolving to support sustainable practices, further enhancing market potential. Leading countries in the MEA region include South Africa and the UAE, where local players are beginning to establish a foothold. The competitive landscape is characterized by a mix of local and international companies, with opportunities for growth in innovative packaging solutions. As the region continues to develop, the thermoformed plastics market is expected to gain traction, driven by rising consumer demand and investment in infrastructure.