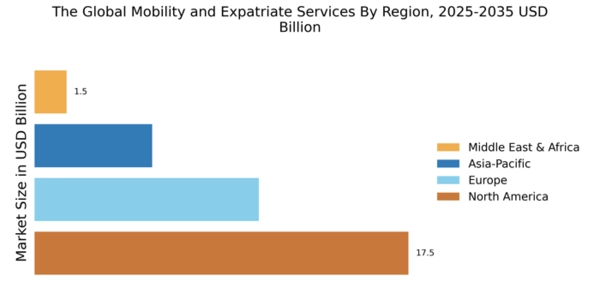

North America : Market Leader in Mobility Services

North America continues to lead The Global Mobility and Expatriate Services, holding a significant market share of 17.5 in 2024. The region's growth is driven by increasing globalization, a rise in cross-border employment, and supportive regulatory frameworks that facilitate international assignments. Companies are increasingly investing in mobility solutions to enhance employee satisfaction and retention, further fueling demand for these services.

The competitive landscape in North America is robust, featuring key players such as Cartus, SIRVA, and Fragomen. These companies are leveraging technology to streamline processes and improve service delivery. The U.S. remains the largest market, with Canada also showing strong growth potential. The presence of established firms and innovative startups contributes to a dynamic environment, ensuring that North America remains at the forefront of global mobility solutions.

Europe : Emerging Mobility Hub

Europe's The Global Mobility and Expatriate Services is valued at 10.5, reflecting a growing demand for mobility solutions across the continent. Factors such as increased intra-European migration, evolving labor laws, and a focus on talent retention are driving this growth. Regulatory changes aimed at simplifying cross-border employment are also acting as catalysts, making it easier for companies to deploy talent across borders.

Leading countries in this region include Germany, the UK, and France, which are home to many multinational corporations. The competitive landscape features established players like Move Guides and InterNations, who are adapting to the changing needs of businesses and expatriates. The presence of diverse cultures and languages in Europe further enhances the demand for tailored mobility services, positioning the region as a key player in the global market.

Asia-Pacific : Rapidly Growing Market

The Asia-Pacific region, with a market size of 5.5, is witnessing rapid growth in The Global Mobility and Expatriate Services. This growth is driven by increasing foreign investments, a burgeoning expatriate population, and a rising demand for skilled labor across borders. Countries in this region are also implementing policies to attract global talent, further enhancing the market's potential. Regulatory frameworks are evolving to support international assignments, making it easier for companies to navigate the complexities of mobility.

Key players in the Asia-Pacific market include Global Mobility Solutions and Altair Global, who are focusing on providing customized solutions to meet the diverse needs of businesses. Countries like China, India, and Australia are leading the charge, with significant investments in mobility services. The competitive landscape is becoming increasingly dynamic, as companies strive to differentiate themselves through innovative offerings and superior customer service.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region, with a market size of 1.5, presents emerging opportunities in The Global Mobility and Expatriate Services. The growth is fueled by increasing expatriate populations, economic diversification efforts, and a focus on attracting foreign talent. Countries in this region are implementing policies to enhance workforce mobility, which is crucial for economic development and competitiveness. The regulatory environment is gradually improving, making it easier for companies to manage international assignments.

Leading countries in this region include the UAE and South Africa, which are becoming hubs for expatriates. The competitive landscape is characterized by a mix of local and international players, with companies adapting their services to meet the unique needs of the region. As the market matures, there is a growing emphasis on technology-driven solutions to streamline mobility processes and enhance the overall experience for expatriates.