Global Supply Chain Complexity

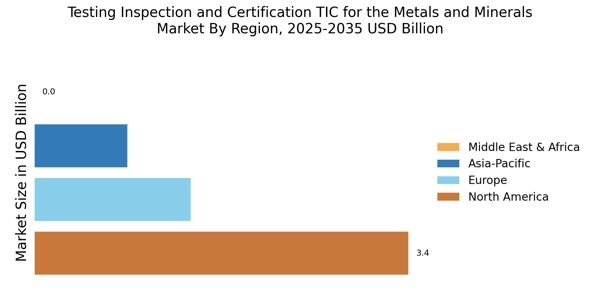

The complexity of The Testing Inspection and Certification TIC for the Metals and Minerals Industry. As companies source materials from diverse geographical locations, ensuring quality and compliance becomes increasingly challenging. This complexity drives the demand for TIC services that can provide assurance throughout the supply chain, from extraction to final product delivery. The TIC market is expected to grow as businesses seek to mitigate risks associated with supply chain disruptions and quality inconsistencies. Enhanced transparency and traceability in supply chains are likely to become critical factors, further elevating the role of TIC services in ensuring product integrity.

Stringent Regulatory Frameworks

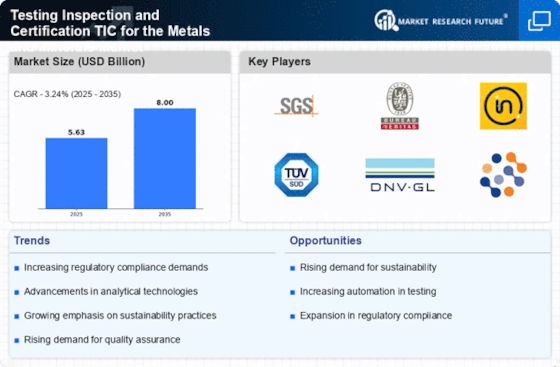

The enforcement of stringent regulatory frameworks across various regions significantly influences the Testing Inspection and Certification TIC for the Metals and Minerals Market. Governments and regulatory bodies are increasingly mandating compliance with safety and environmental standards, compelling companies to invest in TIC services. For example, regulations concerning hazardous materials and emissions have led to a surge in demand for certification services that ensure compliance. The TIC market is expected to benefit from these regulatory pressures, as companies seek to avoid penalties and enhance their market reputation. This trend indicates a robust growth trajectory for TIC services, as adherence to regulations becomes a critical component of operational strategy.

Rising Demand for Quality Assurance

The increasing emphasis on quality assurance in the metals and minerals sector drives the Testing Inspection and Certification TIC for the Metals and Minerals Market. Companies are compelled to ensure that their products meet stringent quality standards to maintain competitiveness. This demand is reflected in the projected growth of the TIC market, which is expected to reach USD 50 billion by 2026. As industries expand, the need for reliable testing and certification services becomes paramount, ensuring that materials are safe and compliant with international standards. Furthermore, the rise in consumer awareness regarding product quality necessitates rigorous testing protocols, thereby enhancing the role of TIC services in the supply chain.

Sustainability and Environmental Concerns

The growing focus on sustainability and environmental stewardship is reshaping the Testing Inspection and Certification TIC for the Metals and Minerals Market. Companies are increasingly required to demonstrate their commitment to sustainable practices, which includes responsible sourcing and minimizing environmental impact. This shift is driving demand for TIC services that assess environmental compliance and sustainability metrics. The market for TIC services is projected to expand as organizations seek to align with sustainability goals and meet consumer expectations. Furthermore, the emphasis on sustainable practices is likely to lead to the development of new certification standards, creating additional opportunities for TIC providers.

Technological Integration in Testing Processes

The integration of advanced technologies such as automation, artificial intelligence, and data analytics is transforming the Testing Inspection and Certification TIC for the Metals and Minerals Market. These technologies enhance the efficiency and accuracy of testing processes, allowing for quicker turnaround times and more reliable results. For instance, the use of AI in predictive maintenance can significantly reduce downtime in mining operations, which is crucial for maintaining productivity. The market for TIC services is projected to grow at a compound annual growth rate of 5.5% through 2025, driven by these technological advancements. As companies adopt these innovations, the demand for TIC services that leverage such technologies is likely to increase.