Increased Demand for Remote Services

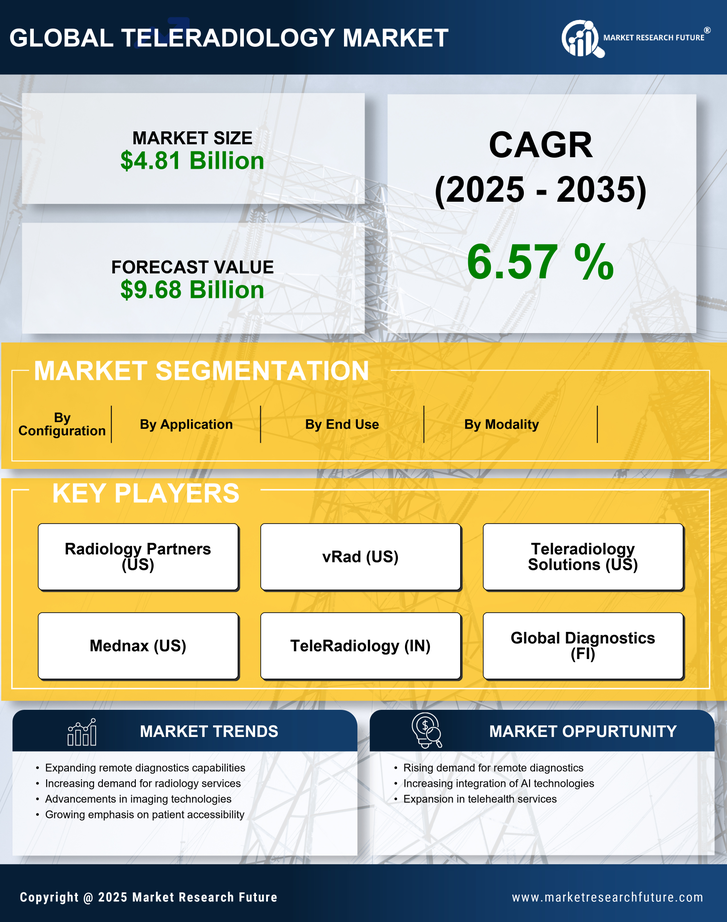

The Teleradiology Market is witnessing an increased demand for remote services, driven by the need for accessible healthcare solutions. Patients and healthcare providers are increasingly seeking remote consultations and diagnostics, particularly in underserved areas where access to radiologists is limited. This trend is supported by the growing acceptance of telehealth services, which has expanded the reach of radiology services beyond traditional settings. According to recent data, the market for teleradiology is expected to grow significantly, with estimates suggesting a valuation exceeding 5 billion dollars by 2026. This shift towards remote services is reshaping the landscape of the Teleradiology Market, making it a crucial driver of growth.

Rising Incidence of Chronic Diseases

The Teleradiology Market is significantly influenced by the rising incidence of chronic diseases, which necessitate regular imaging and monitoring. Conditions such as cancer, cardiovascular diseases, and neurological disorders require timely and accurate radiological assessments. The increasing prevalence of these diseases is driving the demand for teleradiology services, as healthcare providers seek efficient ways to manage patient care. Data suggests that the number of imaging procedures is expected to rise in tandem with the growing patient population suffering from chronic conditions. This trend underscores the importance of teleradiology in providing timely diagnostics and treatment, positioning it as a key driver in the Teleradiology Market.

Technological Advancements in Imaging

The Teleradiology Market is experiencing a surge in technological advancements, particularly in imaging modalities such as MRI, CT, and ultrasound. Innovations in artificial intelligence and machine learning are enhancing image analysis, leading to quicker and more accurate diagnoses. For instance, AI algorithms can now assist radiologists by identifying anomalies in images with remarkable precision. This technological evolution not only improves patient outcomes but also increases the efficiency of radiology departments. As a result, the demand for teleradiology services is likely to rise, with projections indicating a compound annual growth rate of over 15% in the coming years. The integration of advanced imaging technologies is thus a pivotal driver in the Teleradiology Market.

Regulatory Support and Reimbursement Policies

Regulatory support plays a vital role in the Teleradiology Market, as favorable policies can enhance the adoption of teleradiology services. Governments and health organizations are increasingly recognizing the importance of telemedicine, leading to the establishment of reimbursement policies that support remote radiology services. These policies not only incentivize healthcare providers to adopt teleradiology but also ensure that patients receive necessary imaging services without financial barriers. The implementation of such regulations is likely to bolster the market, with projections indicating a steady increase in teleradiology utilization rates. As regulatory frameworks evolve, they are expected to further drive growth in the Teleradiology Market.

Growing Focus on Cost-Effective Healthcare Solutions

The Teleradiology Market is propelled by a growing focus on cost-effective healthcare solutions. As healthcare costs continue to rise, both providers and patients are seeking ways to reduce expenses while maintaining quality care. Teleradiology Market offers a viable solution by minimizing the need for physical infrastructure and allowing for remote consultations, which can lead to significant cost savings. Furthermore, studies indicate that teleradiology can reduce the time to diagnosis, thereby potentially lowering overall treatment costs. This emphasis on cost efficiency is likely to drive the adoption of teleradiology services, making it a prominent factor in the Teleradiology Market.