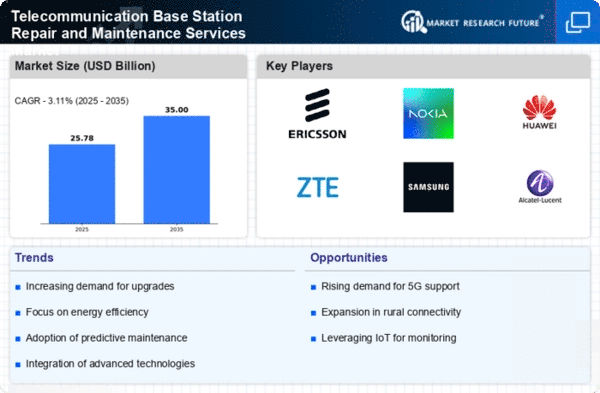

The Telecommunication Base Station Repair and Maintenance Services Market is characterized by a dynamic competitive landscape, driven by the increasing demand for reliable connectivity and the rapid evolution of telecommunications technology. Key players such as Ericsson (SE), Nokia (FI), and Huawei (CN) are at the forefront, each adopting distinct strategies to enhance their market positioning. Ericsson (SE) focuses on innovation and digital transformation, investing heavily in next-generation technologies to streamline operations and improve service delivery. Meanwhile, Nokia (FI) emphasizes strategic partnerships and regional expansion, aiming to strengthen its global footprint and enhance service capabilities. Huawei (CN), on the other hand, leverages its extensive R&D capabilities to drive technological advancements, positioning itself as a leader in 5G infrastructure and maintenance services. Collectively, these strategies contribute to a competitive environment that is increasingly shaped by technological innovation and strategic collaborations.In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to enhance operational efficiency. The market appears moderately fragmented, with several key players exerting significant influence. This structure allows for a diverse range of service offerings, catering to various customer needs while fostering competition among established and emerging players.

In November Ericsson (SE) announced a strategic partnership with a leading cloud service provider to enhance its repair and maintenance capabilities through AI-driven analytics. This collaboration is expected to improve predictive maintenance, thereby reducing downtime and operational costs for telecommunications operators. The integration of AI into maintenance services signifies a pivotal shift towards more proactive service models, aligning with industry trends towards digitalization.

In October Nokia (FI) launched a new suite of maintenance solutions designed specifically for 5G networks, aimed at optimizing performance and reliability. This initiative underscores Nokia's commitment to addressing the unique challenges posed by next-generation networks, positioning the company as a key player in the evolving landscape of telecommunications services. By focusing on 5G-specific solutions, Nokia is likely to capture a larger share of the market as demand for advanced connectivity solutions continues to rise.

In September Huawei (CN) expanded its service portfolio by introducing a comprehensive maintenance program tailored for rural and underserved areas. This move not only enhances Huawei's service reach but also aligns with global efforts to bridge the digital divide. By addressing the needs of underserved markets, Huawei is likely to strengthen its competitive position while contributing to broader societal goals.

As of December the competitive trends in the Telecommunication Base Station Repair and Maintenance Services Market are increasingly defined by digitalization, sustainability, and AI integration. Strategic alliances are becoming more prevalent, as companies recognize the need for collaborative approaches to tackle complex challenges. Looking ahead, competitive differentiation is expected to evolve, with a notable shift from price-based competition towards innovation, technology, and supply chain reliability. This transition may redefine the parameters of success in the market, emphasizing the importance of agility and responsiveness in meeting customer demands.