Telecom Battery Market Summary

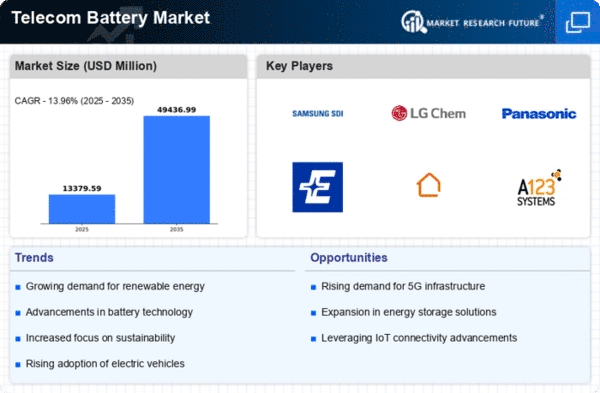

As per MRFR analysis, the Telecom Battery Market Size was estimated at 11740.6 USD Million in 2024. The Telecom Battery industry is projected to grow from 13379.83 USD Million in 2025 to 49436.99 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 13.96 during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Telecom Battery Market is experiencing a transformative shift towards sustainable and advanced energy solutions.

- The market is witnessing a notable shift towards renewable energy solutions, driven by environmental concerns.

- Smart battery technologies are emerging, enhancing efficiency and performance in telecom applications.

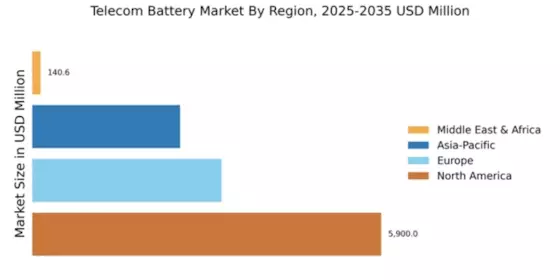

- North America remains the largest market, while Asia-Pacific is recognized as the fastest-growing region in telecom battery adoption.

- The increasing demand for mobile connectivity and advancements in battery technology are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 11740.6 (USD Million) |

| 2035 Market Size | 49436.99 (USD Million) |

| CAGR (2025 - 2035) | 13.96% |

Major Players

Samsung SDI (KR), LG Chem (KR), Panasonic (JP), Exide Technologies (US), Saft (FR), A123 Systems (US), EnerSys (US), GS Yuasa (JP), Amperex Technology (CN)