North America : Market Leader in Technology Integration

North America continues to lead the Technology Integration Consulting Services market, holding a significant share of 36.0% as of 2024. The region's growth is driven by rapid technological advancements, increased digital transformation initiatives, and a strong regulatory framework that encourages innovation. Companies are increasingly investing in cloud computing, AI, and IoT, which are pivotal in shaping the future of technology integration services.

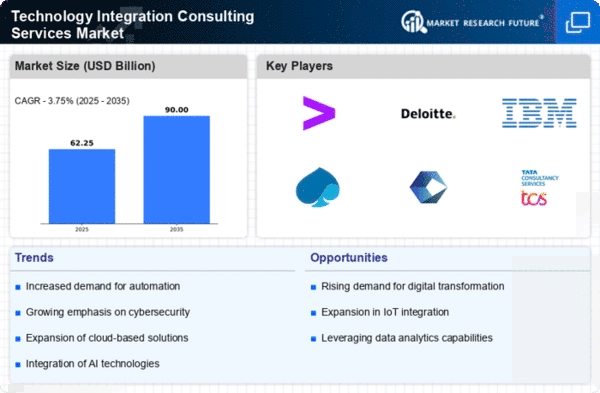

The competitive landscape is robust, with key players like IBM, Accenture, and Deloitte dominating the market. The U.S. is the primary contributor, supported by a strong ecosystem of tech firms and startups. The presence of major consulting firms enhances service delivery and innovation, making North America a hub for technology integration. The region's focus on cybersecurity and compliance further strengthens its market position.

Europe : Emerging Market with Growth Potential

Europe's Technology Integration Consulting Services market is valued at €12.0 billion, reflecting a growing demand for digital solutions across various sectors. The region is witnessing a surge in investments aimed at enhancing operational efficiency and customer engagement through technology. Regulatory frameworks, such as the GDPR, are also driving companies to seek expert consulting services to ensure compliance and data protection, thus fueling market growth.

Leading countries like Germany, France, and the UK are at the forefront of this expansion, with a competitive landscape featuring firms like Capgemini and PwC. The presence of established players and a focus on sustainability and innovation are key drivers. As European businesses increasingly adopt digital transformation strategies, the demand for technology integration consulting services is expected to rise significantly.

Asia-Pacific : Rapid Growth in Emerging Economies

The Asia-Pacific region, with a market size of $8.0 billion, is experiencing rapid growth in Technology Integration Consulting Services. This growth is primarily driven by the increasing adoption of digital technologies among businesses in emerging economies like India and China. The demand for cloud services, AI, and big data analytics is propelling companies to seek expert consulting services to enhance their operational capabilities and competitiveness.

Countries such as India and China are leading the charge, with a burgeoning number of tech startups and established firms like Tata Consultancy Services and Infosys playing pivotal roles. The competitive landscape is evolving, with local players gaining traction alongside global firms. As governments in the region promote digital initiatives, the market for technology integration services is expected to expand significantly in the coming years.

Middle East and Africa : Growing Market with Unique Challenges

The Middle East and Africa region, valued at $4.0 billion, is gradually emerging as a significant player in the Technology Integration Consulting Services market. The growth is driven by increasing investments in technology infrastructure and a rising demand for digital transformation across various sectors. Governments are actively promoting initiatives to enhance technological capabilities, which is fostering a conducive environment for consulting services.

Countries like the UAE and South Africa are leading the market, with a mix of local and international players competing for market share. The presence of firms like Wipro and Cognizant highlights the competitive landscape. However, challenges such as regulatory hurdles and varying levels of technological adoption across countries remain. As the region continues to invest in technology, the demand for integration services is expected to grow.