Regulatory Compliance Pressure

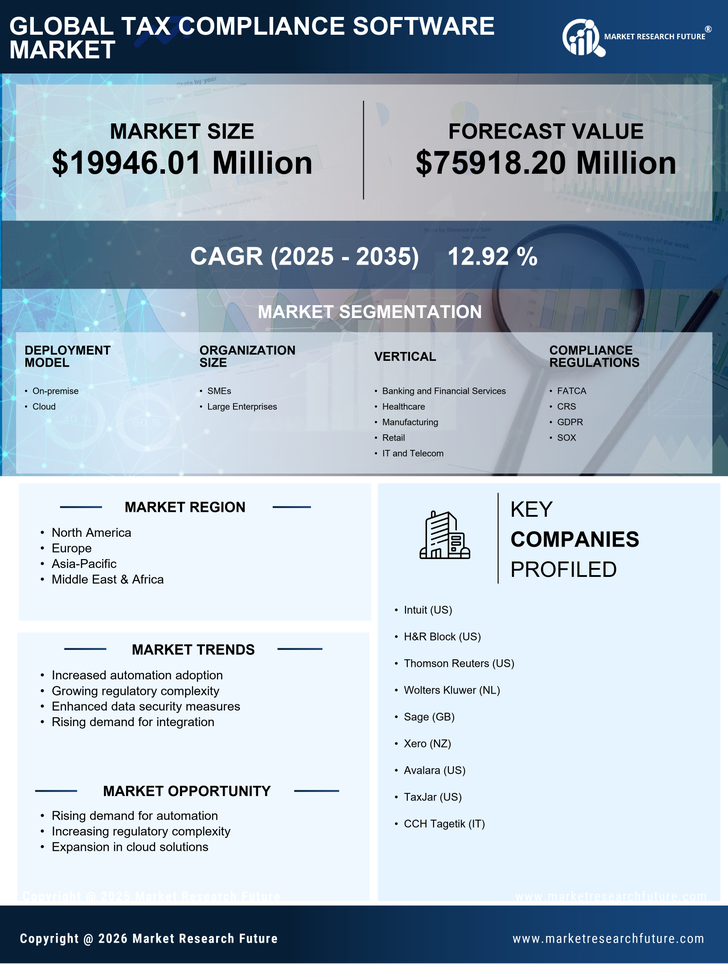

The Tax Compliance Software Market is experiencing heightened pressure from regulatory bodies, necessitating businesses to adopt robust compliance solutions. Governments worldwide are increasingly implementing stringent tax regulations, which require organizations to maintain accurate records and submit timely reports. This trend is evident as the number of tax audits has risen, compelling companies to invest in software that ensures adherence to these regulations. In 2025, it is estimated that the demand for tax compliance solutions will grow by approximately 15%, driven by the need for businesses to avoid penalties and legal repercussions. Consequently, the Tax Compliance Software Market is likely to see a surge in adoption as firms prioritize compliance to mitigate risks associated with non-compliance.

Growing Complexity of Tax Codes

The Tax Compliance Software Market is significantly influenced by the increasing complexity of tax codes across various jurisdictions. As tax laws evolve, businesses face challenges in understanding and implementing these changes effectively. This complexity necessitates the use of sophisticated software solutions that can adapt to new regulations and provide accurate calculations. In 2025, it is projected that the market for tax compliance software will expand by 12%, as organizations seek tools that simplify the navigation of intricate tax codes. The ability of tax compliance software to automate updates and ensure compliance with the latest regulations positions it as an essential asset for businesses aiming to streamline their tax processes.

Adoption of Cloud-Based Solutions

The Tax Compliance Software Market is experiencing a significant shift towards cloud-based solutions, which offer flexibility and scalability for businesses of all sizes. Cloud technology enables organizations to access their tax compliance software from anywhere, facilitating remote work and collaboration. This trend is particularly relevant in 2025, as more companies are expected to migrate to cloud-based platforms, leading to an estimated 18% growth in the market. The advantages of cloud solutions, such as automatic updates and reduced IT overhead, make them an attractive option for businesses seeking efficient tax compliance management. As organizations increasingly recognize the benefits of cloud technology, the Tax Compliance Software Market is likely to see a continued rise in adoption rates.

Increased Focus on Financial Transparency

The Tax Compliance Software Market is benefiting from an increased focus on financial transparency among businesses. Stakeholders, including investors and consumers, are demanding greater accountability in financial reporting and tax practices. This shift is prompting organizations to adopt tax compliance software that enhances transparency and provides detailed reporting capabilities. In 2025, it is projected that the market will grow by 10% as companies recognize the importance of demonstrating compliance and ethical tax practices. The integration of advanced reporting features in tax compliance software not only aids in meeting regulatory requirements but also fosters trust among stakeholders, thereby driving further adoption in the industry.

Rise of E-commerce and Digital Transactions

The Tax Compliance Software Market is witnessing a notable impact from the rise of e-commerce and digital transactions. As online sales continue to grow, businesses are increasingly required to manage sales tax compliance across multiple jurisdictions. This trend has led to a surge in demand for tax compliance software that can handle the complexities associated with varying tax rates and regulations. In 2025, it is anticipated that the e-commerce sector will contribute significantly to the growth of the tax compliance software market, with an expected increase of 20% in software adoption among online retailers. The ability of tax compliance solutions to integrate seamlessly with e-commerce platforms is likely to enhance their appeal in this rapidly evolving market.