Market Trends

Key Emerging Trends in the Tantalum Capacitors for 5G Base Stations Market

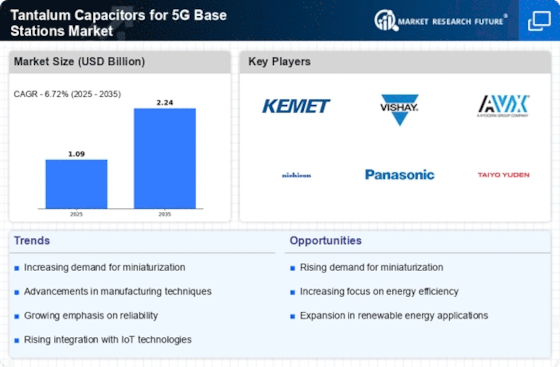

The market trends in tantalum capacitors within the domain of 5G base stations reflect the dynamic landscape of the telecommunications industry. One prominent trend is the relentless growth of 5G technology. The widespread deployment of 5G networks, driven by the insatiable demand for higher data speeds and lower latency, has a direct impact on the tantalum capacitor market. As more regions and countries embrace 5G, the demand for 5G base stations, and subsequently tantalum capacitors, continues to surge. This trend is expected to persist as 5G networks become the new standard in telecommunications.

Miniaturization is another noteworthy trend in the tantalum capacitor market. With the drive towards smaller and more compact electronic devices, there is an increasing emphasis on miniaturizing components without compromising performance. Tantalum capacitors, known for their high capacitance in a small form factor, align with this trend perfectly. Manufacturers are investing in research and development to further shrink the size of tantalum capacitors, making them ideal for the compact design requirements of 5G base stations and other electronic devices.

The focus on energy efficiency is a prevailing trend influencing the tantalum capacitor market. As sustainability gains prominence globally, there is a growing emphasis on developing energy-efficient electronic components. Tantalum capacitors play a crucial role in this context, contributing to the overall efficiency of 5G base stations by providing stable power supply and optimizing energy usage. This trend aligns with the broader industry shift towards environmentally friendly and energy-efficient technologies.

In terms of material sustainability, there is a rising trend towards responsible sourcing of tantalum. Manufacturers are increasingly aware of the environmental and ethical implications of raw material extraction. Tantalum, a key component of capacitors, is sourced from a limited number of mines globally. Companies are adopting sustainable and ethical sourcing practices to meet regulatory requirements and consumer expectations. This trend reflects a broader industry commitment to responsible business practices and environmental stewardship.

The integration of advanced materials is reshaping the tantalum capacitor market. Researchers and manufacturers are exploring new materials and formulations to enhance the performance and reliability of tantalum capacitors. This includes advancements in dielectric materials, which are critical for capacitor functionality. These innovations aim to address challenges such as increasing capacitance, reducing leakage currents, and improving overall capacitor performance in the demanding environment of 5G base stations.

Another significant trend is the increasing use of tantalum capacitors in emerging technologies beyond traditional telecommunications. As the Internet of Things (IoT) and smart devices become more prevalent, tantalum capacitors find applications in diverse electronic devices. From smart home appliances to wearable devices and industrial IoT applications, the versatility of tantalum capacitors positions them as a crucial component in the broader landscape of electronic technology.

Market trends also reflect the heightened importance of quality control and reliability in tantalum capacitors. As 5G technology introduces more complex and interconnected systems, the reliability of electronic components becomes paramount. Manufacturers are investing in rigorous testing and quality assurance processes to ensure that tantalum capacitors meet the stringent performance requirements of 5G base stations and other critical applications.

Leave a Comment