Infrastructure Development Projects

Infrastructure development projects are significantly influencing the Tanker Truck Market. Governments and private sectors are investing heavily in infrastructure, including roads and highways, to facilitate better transportation networks. In 2025, it is estimated that infrastructure spending will reach unprecedented levels, which will directly impact the efficiency of tanker truck operations. Improved infrastructure not only enhances the movement of goods but also reduces transit times, thereby increasing the demand for tanker trucks. The construction of new refineries and distribution centers further amplifies this trend, as these facilities require reliable transportation solutions for fuel and other liquids. Consequently, the tanker truck market is poised for growth as infrastructure projects continue to expand.

Rising Demand for Fuel Transportation

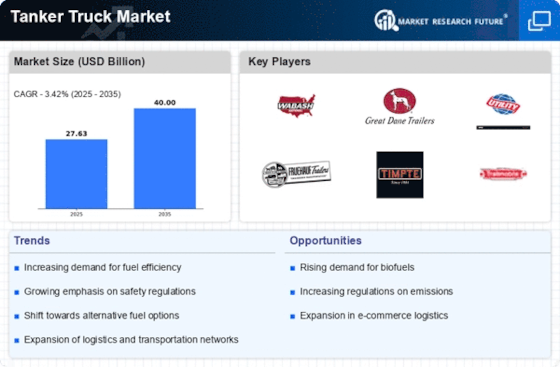

The increasing demand for fuel transportation is a primary driver of the Tanker Truck Market. As economies expand, the need for efficient fuel distribution becomes paramount. In 2025, the demand for diesel and gasoline is projected to rise, necessitating a robust tanker truck fleet to meet this need. The tanker truck industry is expected to witness a compound annual growth rate of approximately 4.5% over the next few years, driven by the growing energy sector. Furthermore, the shift towards cleaner fuels, such as biofuels, is likely to create additional demand for specialized tanker trucks designed for these products. This evolving landscape indicates that the tanker truck market will continue to adapt to meet the changing needs of fuel transportation.

Environmental Regulations and Compliance

Environmental regulations and compliance are increasingly shaping the Tanker Truck Market. Stricter regulations regarding emissions and safety standards are compelling companies to invest in modern tanker trucks that meet these requirements. In 2025, it is anticipated that regulatory bodies will enforce even more stringent guidelines, pushing the industry towards cleaner technologies. This shift may lead to a surge in demand for eco-friendly tanker trucks, which are designed to minimize environmental impact. Companies that proactively adapt to these regulations are likely to gain a competitive edge in the market. Thus, the tanker truck industry is expected to evolve in response to these regulatory pressures, fostering innovation and sustainability.

Growth of E-commerce and Logistics Sector

The growth of the e-commerce and logistics sector is a significant driver of the Tanker Truck Market. As online shopping continues to gain traction, the demand for efficient logistics solutions, including tanker trucks for liquid transportation, is on the rise. In 2025, the logistics sector is projected to expand, with an increasing need for reliable transportation of various goods, including fuels and chemicals. This trend is likely to create new opportunities for tanker truck manufacturers and operators, as they adapt to the evolving needs of the logistics industry. The integration of advanced logistics technologies, such as route optimization and fleet management systems, will further enhance the efficiency of tanker truck operations, thereby supporting market growth.

Technological Innovations in Tanker Design

Technological innovations in tanker design are reshaping the Tanker Truck Market. Advances in materials and engineering have led to the development of lighter, more durable tankers that can carry larger volumes while maintaining safety standards. In 2025, the introduction of smart tankers equipped with IoT technology is expected to enhance operational efficiency and safety. These innovations allow for real-time monitoring of cargo conditions, which is crucial for transporting sensitive materials. Additionally, the integration of automated systems in tanker trucks is likely to reduce human error and improve overall performance. As these technologies become more prevalent, they will drive the tanker truck market towards greater efficiency and sustainability.