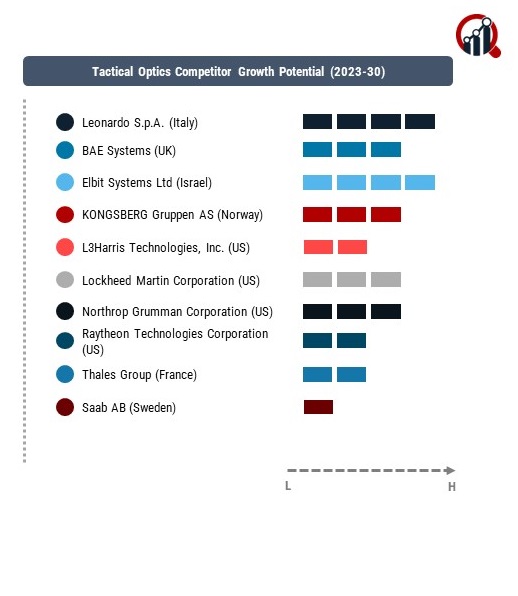

Top Industry Leaders in the Tactical Optics Market

Tactical Optics Market

The Tactical Optics market has witnessed dynamic growth in recent years, fueled by increasing global security concerns and advancements in technology. As the demand for high-performance optical solutions continues to rise, the competitive landscape of the Tactical Optics market has become increasingly diverse and competitive. This article explores the key players, strategies, market share analysis factors, emerging companies, industry news, and investment trends shaping the current competitive scenario in the Tactical Optics market.

Key Players:

Leonardo S.p.A. (Italy)

BAE Systems (UK)

Elbit Systems Ltd (Israel)

KONGSBERG Gruppen AS (Norway)

L3Harris Technologies, Inc. (US)

Lockheed Martin Corporation (US)

Northrop Grumman Corporation (US)

Raytheon Technologies Corporation (US)

Thales Group (France)

Saab AB (Sweden)

Rafael Advanced Defense Systems Ltd. (Israel)

FLIR Systems, Inc. (US)

Israel Aerospace Industries (Israel)

Wuhan JOHO Technology Co., Ltd (China)

AimpointAB (Sweden)

ATN Corporation (US)

Bushnell Corporation (US)

Burris Company, Inc (US)

LEUPOLD & STEVENS, INC. (US)

NIGHTFORCE OPTICS (US)

SIG SAUER (US)

Sightmark (US)

Trijicon, Inc. (US)

Vortex Optics (US)

Strategies Adopted: To maintain a competitive edge, key players in the Tactical Optics market employ various strategies. Product differentiation is a common approach, with companies investing heavily in research and development to introduce cutting-edge technologies like holographic sights, smart optics, and integrated ballistic calculators. Additionally, strategic partnerships and collaborations with defense organizations enhance market penetration and provide access to new technologies. Trijicon, for instance, has been successful in combining innovation with strategic partnerships to strengthen its position.

Factors for Market Share Analysis: Several factors contribute to the analysis of market share in the Tactical Optics industry. Product performance, durability, and cost-effectiveness are critical considerations for end-users. Furthermore, global reach and distribution networks play a vital role in establishing market dominance. Brand reputation and customer loyalty are also pivotal, as users often prefer to stick with trusted brands in mission-critical applications. An in-depth analysis of customer reviews, government contracts, and market surveys helps gauge the market share dynamics accurately.

New and Emerging Companies: The Tactical Optics market is witnessing the emergence of new players eager to disrupt the status quo. Holosun, a relative newcomer, has gained attention with its innovative solar-powered optics and affordable pricing. Another noteworthy entrant is Swampfox Optics, offering a diverse range of optics with a focus on customization. These new players bring fresh perspectives and agile business models, challenging established norms and reshaping the competitive landscape.

Industry News: Recent developments in the Tactical Optics market have been marked by technological advancements and strategic business moves. The adoption of Artificial Intelligence (AI) and Augmented Reality (AR) in optics has garnered attention, with companies exploring ways to integrate these technologies into their products. Additionally, mergers and acquisitions have been prevalent, with larger companies acquiring niche players to expand their product portfolios. Stay-at-home orders and disruptions caused by the global pandemic have also influenced the industry, accelerating the adoption of online sales channels and remote collaboration tools.

Current Company Investment Trends: Investment trends in the Tactical Optics market reflect a focus on innovation, expansion, and sustainability. Companies are allocating significant resources to research and development, aiming to bring forth optics with advanced features and improved performance. Investments in manufacturing facilities and supply chain optimization are also key priorities to meet the growing demand efficiently. Sustainability initiatives, such as reducing the environmental impact of production processes and materials, are gaining importance as consumers and government agencies prioritize eco-friendly solutions.

Overall Competitive Scenario: The overall competitive scenario in the Tactical Optics market is characterized by intense rivalry, technological innovation, and strategic partnerships. Established players are continuously upgrading their product lines, while new entrants challenge the traditional market hierarchy with disruptive offerings. Government contracts and military alliances play a crucial role in determining market leaders, as companies vie for lucrative opportunities to supply optics for defense and law enforcement applications. The future of the Tactical Optics market promises further evolution as advancements in materials, optics, and electronics continue to drive innovation. As the industry navigates geopolitical challenges and embraces emerging technologies, companies that can adapt swiftly and provide reliable, cutting-edge solutions will secure a competitive advantage in this rapidly evolving landscape.

Recent News :

News: Announced a new partnership with NIJ Industries to develop and manufacture advanced electro-optical sight systems for the US military and law enforcement agencies.

Significance: This partnership strengthens Sig Sauer's position in the growing market for advanced tactical optics and could lead to significant contracts in the future.

News: Secured a contract worth $27 million from the Israeli Ministry of Defense to supply advanced helmet-mounted displays for the Israel Defense Forces.

Significance: This contract highlights the growing demand for helmet-mounted displays in the military and could lead to further orders from other countries.

News: Completed the acquisition of DRS Imaging Systems, a leading provider of night vision and thermal imaging technology.

Significance: This acquisition expands L3Harris's capabilities in the tactical optics market and positions it well to compete for large contracts.

News: Unveiled a new long-range thermal imaging sensor that can detect targets at distances of up to 25 kilometers.

Significance: This new sensor could be a game-changer for long-range surveillance applications and could lead to increased sales for Leonardo DRS.