Synthetic Diamond Size

Synthetic Diamond Market Growth Projections and Opportunities

The synthetic diamond market is influenced by a multitude of market factors that shape its dynamics and growth trajectory. One significant factor is technological advancements in diamond synthesis techniques. As technology evolves, the efficiency and cost-effectiveness of producing synthetic diamonds improve, thereby impacting market supply and pricing. Additionally, the availability of raw materials plays a crucial role. Synthetic diamonds are typically produced using high-pressure high-temperature (HPHT) or chemical vapor deposition (CVD) methods, both of which require specific precursor materials. Changes in the availability or cost of these materials can directly affect the production volume and pricing of synthetic diamonds.

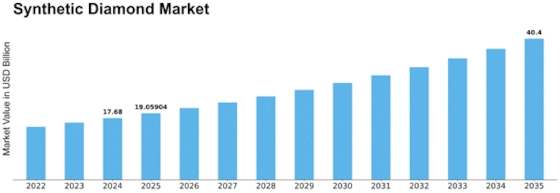

The Synthetic Diamond market industry is projected to grow from USD 16.4 Billion in 2023 to USD 29.9 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 7.80% during the forecast period (2023 - 2032).

Market demand is another key factor driving the synthetic diamond market. The demand for synthetic diamonds stems from various industries such as electronics, construction, and automotive. For instance, in the electronics industry, synthetic diamonds are used extensively in the production of semiconductors and electronic components due to their exceptional thermal conductivity and hardness. As demand for electronics continues to rise, so does the demand for synthetic diamonds. Moreover, increasing awareness among consumers about the environmental and ethical concerns associated with natural diamond mining has led to a growing preference for synthetic diamonds, further driving market demand.

Global economic conditions also impact the synthetic diamond market. Economic growth and stability stimulate demand across industries, leading to increased consumption of synthetic diamonds for various applications. Conversely, economic downturns can result in reduced spending and a slowdown in demand for luxury goods, including diamonds, affecting market growth. Additionally, currency fluctuations and trade policies can influence the competitiveness of synthetic diamond producers in the global market, affecting their market share and profitability.

Government regulations and policies are significant determinants of the synthetic diamond market landscape. Regulations pertaining to environmental standards, labor practices, and product quality impact the operations of synthetic diamond manufacturers. Compliance with regulations often requires investment in technology and infrastructure, which can affect production costs and ultimately, market pricing. Moreover, trade policies and tariffs imposed by governments can affect the flow of synthetic diamonds across borders, influencing market dynamics and competitive positioning.

Consumer preferences and trends also shape the synthetic diamond market. As consumers become more environmentally conscious and socially responsible, there is a growing demand for ethically sourced and sustainable products, including synthetic diamonds. Manufacturers are responding to this trend by emphasizing the eco-friendliness and ethical production practices of synthetic diamonds, thereby influencing consumer choices. Furthermore, changing fashion trends and cultural preferences drive demand for diamond jewelry and accessories, impacting the market for synthetic diamonds.

Competition within the synthetic diamond market is fierce, with numerous manufacturers vying for market share. Factors such as product quality, pricing, brand reputation, and distribution channels play crucial roles in competitive positioning. Companies invest in research and development to innovate new diamond synthesis technologies and improve product quality, giving them a competitive edge in the market. Additionally, strategic partnerships and acquisitions are common strategies employed by companies to expand their market presence and gain a competitive advantage.

Leave a Comment