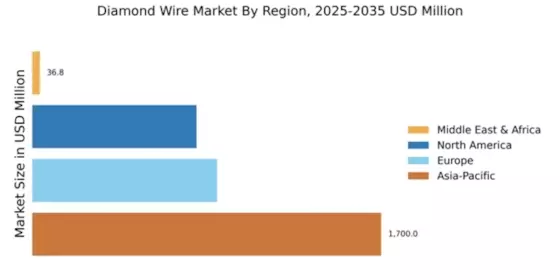

North America : Established Market with Growth Potential

The North American diamond wire market is projected to reach $800.0 million by December 2025, driven by increasing demand in construction and manufacturing sectors. Regulatory support for advanced manufacturing technologies and sustainable practices is expected to further boost market growth. The region's focus on innovation and efficiency in production processes is a key growth driver, alongside rising investments in infrastructure projects.

Leading countries in this region include the United States and Canada, where major players like Diamond Wire Technology and Husqvarna AB are actively expanding their market presence. The competitive landscape is characterized by a mix of established companies and emerging players, all vying for market share. The presence of advanced manufacturing capabilities and a skilled workforce enhances the region's attractiveness for investment in diamond wire technologies.

Europe : Innovation and Sustainability Focus

Europe's diamond wire market is anticipated to reach €900.0 million by December 2025, fueled by a strong emphasis on innovation and sustainability. The region is witnessing a shift towards eco-friendly materials and processes, driven by stringent regulations aimed at reducing environmental impact. This regulatory landscape is a significant catalyst for growth, as companies adapt to meet new standards and consumer preferences for sustainable products.

Key players in Europe include Raimondi S.p.A. and KUKA AG, with countries like Germany and Italy leading the market. The competitive environment is marked by technological advancements and collaborations among industry leaders to enhance product offerings. The presence of robust manufacturing capabilities and a focus on R&D positions Europe as a leader in the diamond wire market.

Asia-Pacific : Emerging Powerhouse in Market Growth

The Asia-Pacific region is set to dominate the diamond wire market, with a projected size of $1,700.0 million by December 2025. This growth is driven by rapid industrialization, urbanization, and increasing investments in infrastructure projects. The demand for advanced cutting technologies in construction and manufacturing is rising, supported by favorable government policies and initiatives aimed at boosting the manufacturing sector.

Leading countries in this region include China, Japan, and India, where major players like Sika AG and Biesse S.p.A. are expanding their operations. The competitive landscape is characterized by a mix of local and international companies, all striving to capture market share. The region's focus on technological innovation and cost-effective solutions is enhancing its position in The Diamond Wire.

Middle East and Africa : Emerging Market with Growth Opportunities

The Middle East and Africa diamond wire market is projected to reach $36.78 million by December 2025, driven by increasing construction activities and a growing demand for advanced cutting technologies. The region is witnessing a gradual shift towards modernization and infrastructure development, supported by government initiatives aimed at enhancing industrial capabilities. This growth is further catalyzed by the rising adoption of diamond wire technology in various sectors.

Countries like the UAE and South Africa are leading the market, with a competitive landscape that includes both local and international players. The presence of key companies and investments in infrastructure projects are expected to drive market growth. As the region continues to develop, opportunities for expansion in the diamond wire market are becoming increasingly apparent.