Top Industry Leaders in the Synthetic Aperture Radar Market

Four new synthetic aperture radar (SAR) satellites were successfully launched on November 11, 2023, from Vandenberg Space Force Base in California, as part of SpaceX's Transporter-9 smallsat ridesharing mission, according to ICEYE in Irvine, California. Regardless of cloud cover, SAR satellites use microwaves to light the ground and then use the energy that is reflected back to the satellite to build pictures. SAR has a strong day/night, all-weather imaging capability, making it superior to classical electro-optical imaging for monitoring and search applications.

On June 12, 2023, ICEYE, the world's foremost provider of continuous surveillance via radar imaging satellites and a specialist in mitigating natural disasters, effectively added four more synthetic aperture radar ("SAR") satellites to its network. SpaceX launched their Transporter-8 smallsat ridesharing mission from Vandenberg Space Force Base in California, USA, using the Exolaunch technology. All spacecraft are doing typical early activities and have successfully established communications. Together with the debut of a new data product called Spot Fine, the next generation ICEYE satellites can scan the Earth with a ground range resolution of 50 cm. The first of a new class of data packages made possible by ICEYE's Generation 3 ("Gen3") satellite technology is this new imaging mode.

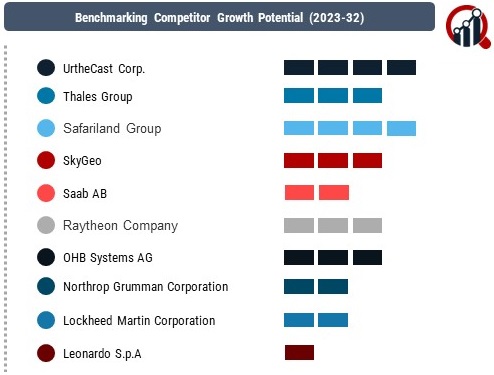

Key Players in Synthetic Aperture Radar Industry

- UrtheCast Corp.

- Thales Group

- SkyGeo

- Saab AB

- Raytheon Company

- OHB Systems AG

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- Leonardo S.p.A.

- ICEYE

- General Atomics

- Cobham plc

- Capella Space

- BAE Systems

- Airbus S.A.S