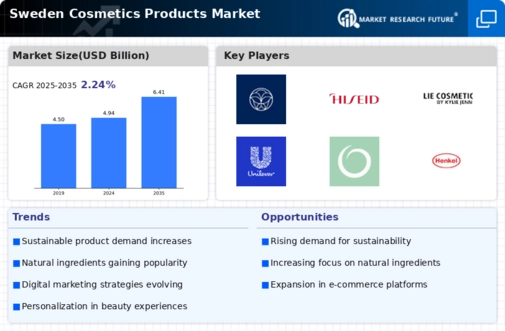

Personalization in Beauty Solutions

Personalization is emerging as a key driver in the Europe Cosmetic Products Market, as consumers seek tailored beauty solutions that cater to their unique needs. The rise of technology, including AI and data analytics, enables brands to offer customized products and experiences. In 2025, it is estimated that personalized beauty products could account for over 30% of the market share in Europe. This trend reflects a broader consumer desire for products that resonate with individual preferences, skin types, and lifestyles. Brands that successfully implement personalization strategies are likely to enhance customer satisfaction and retention, thereby fostering brand loyalty. Furthermore, the ability to provide bespoke solutions positions companies favorably in a competitive landscape, making personalization a vital component of market growth in the Europe Cosmetic Products Market.

Sustainability and Eco-Friendly Products

The growing emphasis on sustainability is a pivotal driver in the Europe Cosmetic Products Market. Consumers increasingly prefer brands that prioritize eco-friendly practices, such as using biodegradable packaging and natural ingredients. In 2025, approximately 60% of European consumers reported a willingness to pay more for sustainable products, indicating a shift in purchasing behavior. This trend is further supported by stringent regulations in the European Union aimed at reducing environmental impact, which compel companies to innovate and adopt greener practices. As a result, brands that align with these values are likely to gain a competitive edge, thereby influencing market dynamics significantly. The focus on sustainability not only enhances brand loyalty but also attracts a broader customer base, making it a crucial factor in the growth of the Europe Cosmetic Products Market.

Regulatory Compliance and Safety Standards

Regulatory compliance plays a crucial role in shaping the Europe Cosmetic Products Market, as stringent safety standards govern product formulation and marketing. The European Union has established comprehensive regulations, such as the Cosmetics Regulation (EC) No 1223/2009, which mandates rigorous safety assessments and labeling requirements. Companies that adhere to these regulations not only ensure consumer safety but also enhance their brand reputation. In 2025, it is anticipated that compliance with these regulations will become even more stringent, compelling brands to invest in research and development to meet evolving standards. This focus on safety and compliance is likely to drive innovation within the industry, as companies seek to develop safer, more effective products. Consequently, regulatory compliance emerges as a significant driver of growth in the Europe Cosmetic Products Market.

Influence of Social Media and Beauty Trends

The influence of social media is a powerful driver in the Europe Cosmetic Products Market, as platforms like Instagram and TikTok shape consumer preferences and trends. In 2025, it is estimated that over 70% of European consumers will rely on social media for beauty inspiration and product recommendations. This trend underscores the importance of influencer marketing and user-generated content in driving brand awareness and sales. Brands that effectively leverage social media strategies are likely to engage with younger demographics, who are increasingly making purchasing decisions based on online trends. Additionally, the rapid dissemination of beauty trends through social media can lead to spikes in demand for specific products, creating both opportunities and challenges for brands. Thus, the impact of social media on consumer behavior is a critical factor influencing the growth of the Europe Cosmetic Products Market.

Digital Transformation and E-Commerce Growth

The rapid digital transformation is reshaping the Europe Cosmetic Products Market, with e-commerce emerging as a dominant sales channel. In 2025, online sales are projected to represent over 40% of total cosmetic sales in Europe, driven by the convenience and accessibility of online shopping. This shift is further accelerated by the increasing use of mobile devices and social media platforms for product discovery and purchasing. Brands that invest in robust e-commerce strategies and digital marketing are likely to capture a larger share of the market. Additionally, the integration of augmented reality and virtual try-on technologies enhances the online shopping experience, making it more interactive and engaging for consumers. As a result, the digital landscape is becoming a critical battleground for brands in the Europe Cosmetic Products Market.