Economic Factors

Economic factors play a pivotal role in shaping the SVOD Market Overview. As disposable incomes rise in various regions, consumers are more willing to invest in subscription services for entertainment. The affordability of SVOD services compared to traditional cable packages is also a compelling factor, as many households seek cost-effective alternatives. Recent data indicates that the average monthly subscription fee for SVOD services remains lower than that of cable television, making it an attractive option for budget-conscious consumers. Furthermore, economic stability encourages spending on leisure activities, including streaming services. As of October 2025, the SVOD Market Overview Industry is likely to benefit from these economic trends, as more individuals prioritize entertainment subscriptions in their monthly budgets. This economic backdrop suggests a favorable environment for the continued growth of SVOD services.

Competitive Landscape

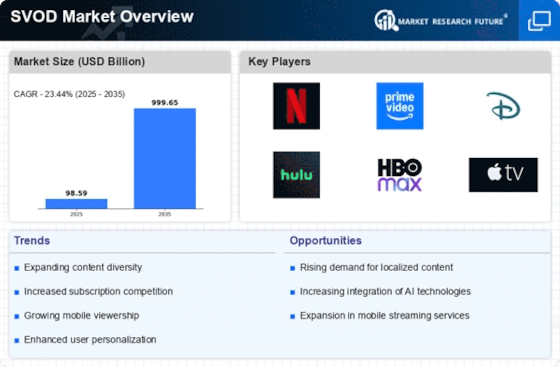

The competitive landscape within the SVOD Market Overview is intensifying, with numerous players vying for market share. Major platforms are not only expanding their content libraries but also investing heavily in original programming to differentiate themselves. As of October 2025, the number of SVOD services has increased substantially, leading to a fragmented market where consumers have a plethora of choices. This competition drives innovation, as companies strive to enhance user experience through features such as personalized recommendations and interactive content. Additionally, partnerships and collaborations among content creators and distributors are becoming more common, further enriching the content available to subscribers. The competitive dynamics suggest that companies must remain agile and responsive to market trends to maintain their subscriber base and ensure growth within the SVOD Market Overview Industry.

Regulatory Environment

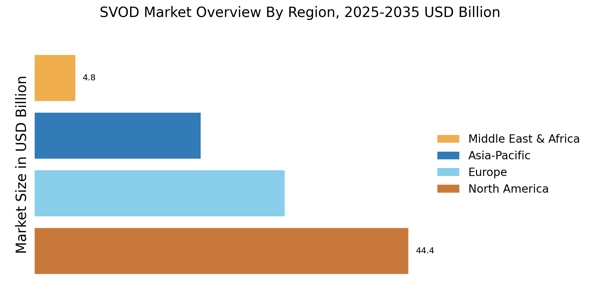

The regulatory environment surrounding the SVOD Market Overview is evolving, impacting how services operate and compete. Governments are increasingly scrutinizing content distribution, data privacy, and copyright issues, which can influence the strategies of SVOD providers. As of October 2025, some regions have implemented regulations that require local content quotas, compelling SVOD platforms to invest in domestic productions. This regulatory shift may create opportunities for local content creators while also challenging international providers to adapt their offerings. Additionally, compliance with data protection laws is becoming paramount, as consumers demand greater transparency regarding their personal information. The regulatory landscape suggests that SVOD companies must navigate complex legal frameworks to thrive, potentially shaping the future direction of the industry.

Technological Advancements

The SVOD Market Overview is experiencing a notable surge due to rapid technological advancements. Innovations in streaming technology, such as improved bandwidth and enhanced compression algorithms, facilitate seamless viewing experiences. As of October 2025, the average internet speed in many regions has increased significantly, allowing for higher quality streaming, including 4K and HDR content. This technological evolution not only enhances user satisfaction but also attracts new subscribers. Furthermore, the proliferation of smart devices, including televisions, tablets, and smartphones, enables consumers to access SVOD services anytime and anywhere. This accessibility is likely to drive subscription growth, as more individuals seek flexible viewing options. The integration of artificial intelligence in content recommendation systems also plays a crucial role, personalizing user experiences and potentially increasing viewer engagement within the SVOD Market Overview Industry.

Changing Consumer Preferences

Consumer preferences are shifting dramatically, influencing the SVOD Market Overview. As audiences increasingly favor on-demand content over traditional broadcasting, subscription video on demand services are becoming more appealing. Recent surveys indicate that a significant percentage of viewers prefer binge-watching series, which SVOD platforms cater to effectively. This trend is further supported by the rise of mobile viewing, as consumers seek convenience and flexibility in their entertainment choices. The demand for diverse content, including international films and niche genres, is also on the rise, prompting SVOD providers to expand their libraries. As of October 2025, the SVOD Market Overview Industry is witnessing a diversification of content offerings, which is likely to attract a broader audience base. This evolution in consumer behavior suggests that SVOD services must continuously adapt to meet the changing tastes and preferences of their subscribers.