Market Share

Sustainable Aviation Fuel Market Share Analysis

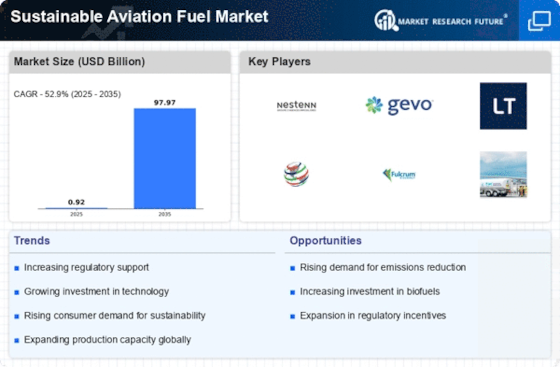

In the burgeoning arena of sustainable aviation fuel (SAF), agencies are strategically positioning themselves to seize marketplace percentage by means of enforcing numerous techniques. A key technique includes technological innovation, where agencies focus on developing superior processes to produce SAF from sustainable feedstocks. They invest in refining technologies that convert waste oils, agricultural residues, or algae into aviation fuel, aiming to provide a cleaner and greener opportunity to traditional jet fuels. By offering terrific SAF that meets aviation industry requirements, such as lowering carbon emissions, organizations aim to cater to airlines and aviation stakeholders devoted to sustainability. Cost management is another pivotal strategy in the sustainable aviation fuel market. Some groups prioritize optimizing manufacturing methods or establishing efficient delivery chains to offer SAF at competitive prices. They work on decreasing production fees via economies of scale, progressive production strategies, or sourcing sustainable feedstocks successfully. This method appeals to airways and aviation companies seeking environmentally friendly gasoline alternatives without considerably impacting their operational budgets. It allows those businesses to seize a sizeable market proportion amongst fee-conscious purchasers. Moreover, brand positioning and popularity drastically impact marketplace proportion in the sustainable aviation fuel sector. Companies invest in constructing strong logo images by emphasizing the environmental blessings, reliability, and certification standards of their SAF merchandise. Establishing a recognition for supplying superb and sustainable aviation fuels not only draws environmentally aware airlines but also fosters belief and loyalty among enterprise stakeholders. Brands acknowledged for their dedication to sustainability and reliability regularly hover over competitors with a bonus in securing contracts or competitors. Strategic collaborations and partnerships are instrumental in increasing market share for sustainable aviation fuel corporations. Teaming up with airways, plane producers, authorities' bodies, or study institutions allows these businesses to get entry to new markets, technologies, or funding possibilities. Collaborations would possibly involve joint ventures for SAF manufacturing, delivering agreements, or studying tasks to enhance SAF efficiency. Such partnerships decorate an organization's marketplace presence and facilitate expansion into new areas or aviation sectors, contributing to accelerated marketplace percentage. Furthermore, non-stop innovation remains crucial in staying competitive in the sustainable aviation fuel market. In precis, the market share positioning strategies inside the sustainable aviation fuel enterprise revolve around technological innovation, cost leadership, marketplace segmentation, logo positioning, strategic partnerships, and continuous innovation. Implementing those strategies enables agencies to deal with diverse aviation sustainability desires, establish a sturdy market presence, and gain an aggressive aspect in a hastily evolving and environmentally conscious aviation panorama.

Leave a Comment