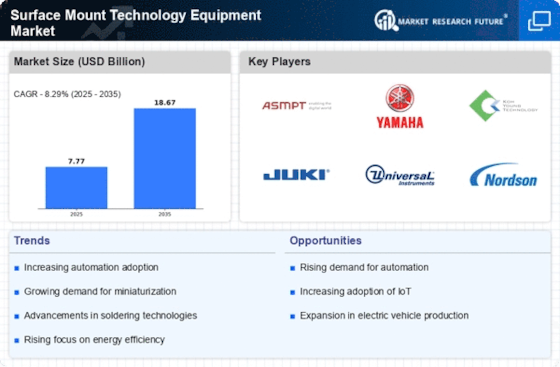

Increased Focus on Energy Efficiency

Energy efficiency has become a focal point for many industries, driving the Surface Mount Technology Equipment Market. As organizations strive to reduce their carbon footprint and operational costs, there is a growing emphasis on developing energy-efficient electronic devices. In 2025, the market for energy-efficient electronics is expected to grow significantly, with surface mount technology playing a pivotal role in this transition. The compact nature of surface mount technology allows for the design of smaller, more efficient circuits that consume less power. Manufacturers are investing in surface mount technology equipment that supports the production of energy-efficient components, aligning with sustainability goals and regulatory requirements. This trend not only benefits the environment but also enhances the competitiveness of manufacturers in a market that increasingly values energy efficiency.

Advancements in Automotive Electronics

The automotive industry is undergoing a transformation, with a significant shift towards electric and autonomous vehicles. This transition is driving the Surface Mount Technology Equipment Market, as modern vehicles increasingly rely on sophisticated electronic systems. In 2025, it is estimated that the automotive electronics market will reach a valuation of over 300 billion dollars, highlighting the critical role of surface mount technology in this sector. The need for reliable and efficient electronic components in vehicles is paramount, as they contribute to safety, performance, and user experience. Consequently, manufacturers are compelled to invest in advanced surface mount technology equipment to ensure they can meet the stringent requirements of the automotive market, which is characterized by rapid innovation and evolving consumer expectations.

Growth of the Internet of Things (IoT)

The proliferation of the Internet of Things (IoT) is significantly influencing the Surface Mount Technology Equipment Market. As more devices become interconnected, the demand for efficient and compact electronic components is escalating. By 2025, the number of connected IoT devices is projected to exceed 30 billion, creating a substantial market for surface mount technology. This growth necessitates the use of advanced surface mount technology equipment to facilitate the production of smaller, more efficient components that can be seamlessly integrated into various applications. The ability to produce high-density interconnections is crucial for IoT devices, which often require miniaturized components to function effectively. As such, manufacturers are increasingly adopting surface mount technology to enhance their production capabilities and meet the rising demand for IoT solutions.

Rising Demand for Consumer Electronics

The increasing demand for consumer electronics is a primary driver of the Surface Mount Technology Equipment Market. As technology advances, consumers are seeking more sophisticated devices, leading to a surge in production. In 2025, the consumer electronics sector is projected to grow at a compound annual growth rate of approximately 6.5%. This growth necessitates the adoption of surface mount technology, which allows for more compact and efficient designs. Manufacturers are investing in advanced surface mount technology equipment to meet this demand, ensuring that they can produce high-quality products at a faster pace. The trend towards miniaturization in electronics further emphasizes the importance of surface mount technology, as it enables the integration of more components into smaller spaces, thereby enhancing functionality and performance.

Emergence of Smart Manufacturing Practices

The rise of smart manufacturing practices is reshaping the Surface Mount Technology Equipment Market. As industries adopt automation and data-driven decision-making, the demand for advanced surface mount technology equipment is on the rise. In 2025, the smart manufacturing market is projected to reach a valuation of over 500 billion dollars, indicating a robust growth trajectory. This shift towards smart manufacturing necessitates the integration of sophisticated surface mount technology equipment that can support high levels of automation and precision. Manufacturers are increasingly leveraging technologies such as artificial intelligence and machine learning to optimize production processes, thereby enhancing efficiency and reducing waste. The adoption of smart manufacturing practices is likely to drive innovation in surface mount technology, as companies seek to remain competitive in an evolving landscape.

Leave a Comment