North America : Market Leader in Services

North America leads the Surface Mining Equipment Repair and Overhaul Services Market, holding a significant share of 12.5 in 2024. The region's growth is driven by increasing mining activities, stringent safety regulations, and a focus on equipment longevity. The demand for efficient repair services is further fueled by technological advancements and the need for sustainable practices in mining operations. Regulatory support for environmental compliance also plays a crucial role in shaping market dynamics.

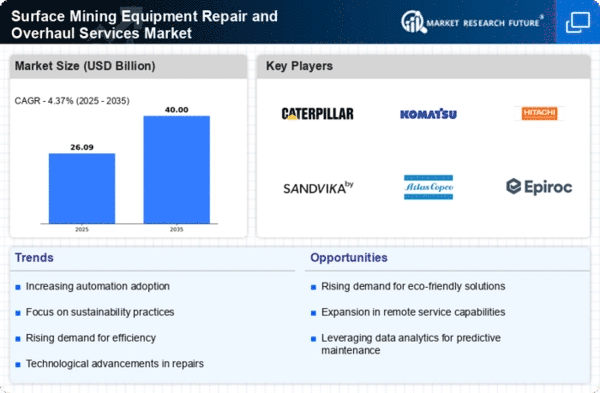

The competitive landscape in North America is characterized by the presence of major players such as Caterpillar Inc, Terex Corporation, and Joy Global Inc. These companies leverage advanced technologies and extensive service networks to maintain their market positions. The U.S. and Canada are the leading countries, with robust mining sectors that require ongoing maintenance and repair services. The focus on innovation and customer-centric solutions continues to drive market growth.

Europe : Emerging Market Dynamics

Europe's Surface Mining Equipment Repair and Overhaul Services Market is projected to reach a size of 6.0 by 2025, driven by increasing demand for efficient mining operations and regulatory frameworks promoting sustainability. The region is witnessing a shift towards advanced repair technologies and eco-friendly practices, which are essential for compliance with stringent EU regulations. The focus on reducing operational costs and enhancing equipment efficiency is also a significant growth driver.

Leading countries in Europe include Germany, Sweden, and Finland, where companies like Sandvik AB and Atlas Copco AB are prominent. The competitive landscape is evolving, with a mix of established players and new entrants focusing on innovative service offerings. The presence of a skilled workforce and strong R&D capabilities further enhances the region's market potential. As the industry adapts to changing regulations, the demand for specialized repair services is expected to grow.

Asia-Pacific : Rapid Growth Potential

The Asia-Pacific region is witnessing significant growth in the Surface Mining Equipment Repair and Overhaul Services Market, projected to reach 5.0 by 2025. Key drivers include increasing mining activities, urbanization, and the rising demand for minerals. Countries like China and India are leading this growth, supported by government initiatives aimed at enhancing mining efficiency and safety. The region's focus on modernization and technological advancements is also a catalyst for market expansion.

China, Japan, and Australia are the leading countries in this market, with major players such as Komatsu Ltd and Hitachi Construction Machinery Co Ltd. The competitive landscape is characterized by a mix of local and international companies, all vying for market share. As the region continues to invest in infrastructure and mining capabilities, the demand for repair and overhaul services is expected to rise significantly, driven by the need for operational efficiency and equipment reliability.

Middle East and Africa : Developing Market Landscape

The Middle East and Africa region is gradually emerging in the Surface Mining Equipment Repair and Overhaul Services Market, with a projected size of 1.5 by 2025. The growth is primarily driven by increasing mining activities, particularly in countries rich in natural resources. Regulatory frameworks are evolving to support sustainable mining practices, which is expected to enhance the demand for repair services. The focus on improving operational efficiency and reducing downtime is also a key driver in this region.

Leading countries include South Africa and the UAE, where mining operations are expanding. The competitive landscape features both local and international players, with companies looking to establish a foothold in this developing market. As the region continues to invest in mining infrastructure, the demand for specialized repair services is anticipated to grow, driven by the need for reliable and efficient equipment maintenance.