Rising Construction Activities

The resurgence of construction activities is a pivotal driver for the Surety Market. As economies recover and urbanization accelerates, there is a marked increase in residential, commercial, and industrial construction projects. In 2025, the construction sector is anticipated to witness a growth rate of around 4.5%, leading to a corresponding rise in the demand for surety bonds. These bonds are essential for contractors to secure financing and demonstrate their reliability to project owners. Furthermore, the Surety Market benefits from the trend of public-private partnerships, where surety bonds are often required to ensure that projects are completed on time and within budget. This growing construction landscape is likely to bolster the surety bond market as stakeholders seek to mitigate risks associated with project execution.

Regulatory Compliance Requirements

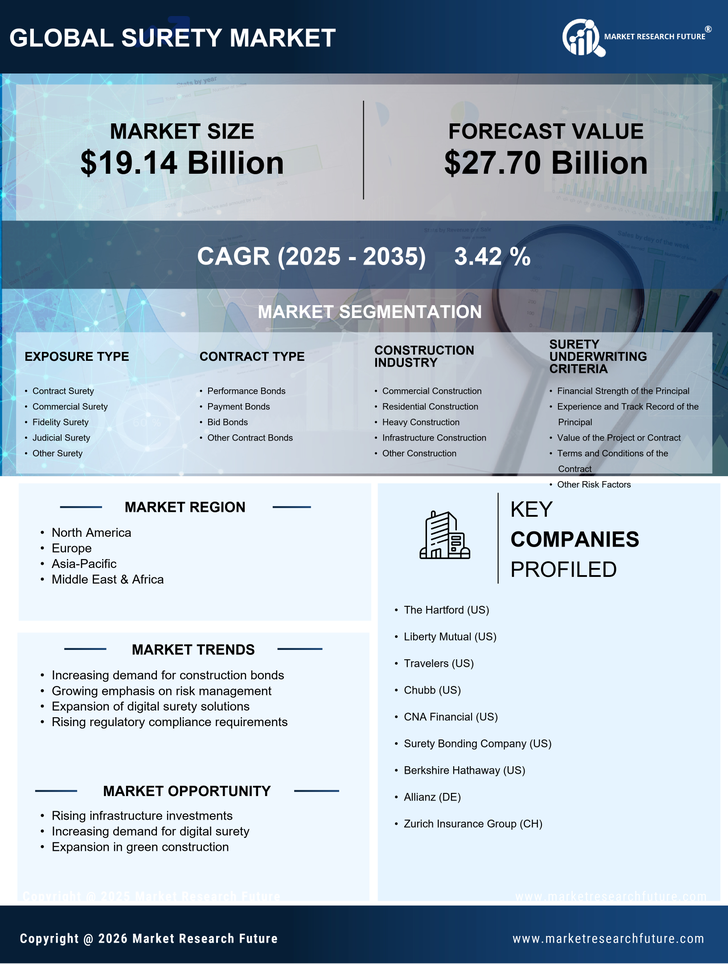

The Surety Market is experiencing heightened demand due to increasing regulatory compliance requirements across various sectors. Governments and regulatory bodies are imposing stricter guidelines, necessitating businesses to secure surety bonds to ensure compliance with laws and regulations. This trend is particularly evident in construction and public works projects, where surety bonds serve as a guarantee that contractors will fulfill their obligations. As of 2025, the surety bond market is projected to grow at a compound annual growth rate of approximately 5.2%, driven by these compliance mandates. Companies that fail to adhere to these regulations may face penalties, thereby increasing the reliance on surety bonds as a risk management tool. Consequently, the Surety Market is likely to expand as businesses seek to mitigate risks associated with non-compliance.

Increased Focus on Financial Stability

An increased focus on financial stability among businesses is shaping the Surety Market. In an environment characterized by economic uncertainties, companies are prioritizing financial health and risk management. Surety Market bonds provide a mechanism for businesses to demonstrate their financial stability and reliability to clients and partners. As of 2025, the demand for surety bonds is expected to rise as organizations seek to enhance their creditworthiness and secure contracts. This trend is particularly relevant in industries such as construction and manufacturing, where financial assurance is critical for project success. The Surety Market is likely to thrive as businesses recognize the value of surety bonds in fostering trust and confidence in their operations.

Infrastructure Development Initiatives

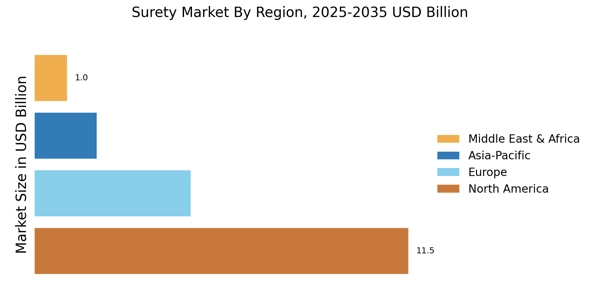

Infrastructure development initiatives are significantly influencing the Surety Market. Governments worldwide are investing heavily in infrastructure projects, including transportation, energy, and public facilities, to stimulate economic growth. These projects often require contractors to obtain surety bonds to guarantee project completion and adherence to quality standards. In 2025, the value of infrastructure spending is expected to reach trillions of dollars, creating a robust demand for surety bonds. This trend not only enhances the credibility of contractors but also assures project owners of financial protection against potential defaults. As a result, the Surety Market is poised for growth, driven by the increasing number of infrastructure projects and the necessity for financial assurances.

Technological Integration in Surety Processes

Technological integration is revolutionizing the Surety Market by streamlining processes and enhancing efficiency. The adoption of digital platforms and data analytics is transforming how surety bonds are underwritten and managed. In 2025, it is projected that technology-driven solutions will account for a significant portion of the surety bond market, as companies leverage these tools to assess risks more accurately and expedite the bonding process. This shift not only reduces operational costs but also improves customer experience by providing faster access to surety bonds. As technology continues to evolve, the Surety Market is likely to see increased competition and innovation, ultimately benefiting stakeholders by offering more tailored and efficient bonding solutions.