North America : Market Leader in Analytics

North America continues to lead the Supply Chain Data Analytics Services Market, holding a significant market share of 10.0 in 2024. The region's growth is driven by advanced technological adoption, increasing demand for data-driven decision-making, and supportive regulatory frameworks. Companies are increasingly leveraging analytics to optimize supply chains, reduce costs, and enhance operational efficiency, contributing to robust market expansion.

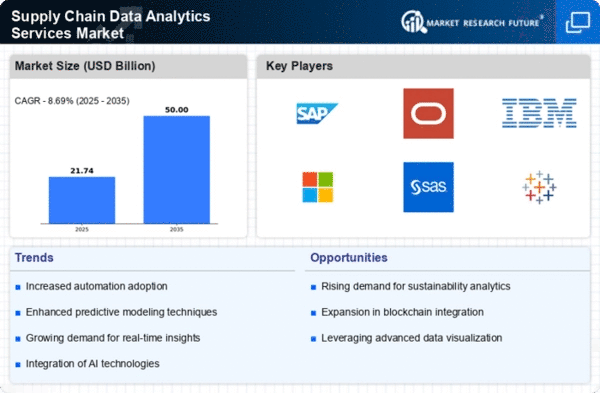

The competitive landscape is characterized by the presence of major players such as SAP, Oracle, and IBM, which are investing heavily in innovative solutions. The U.S. stands out as a key market, supported by a strong infrastructure and a focus on digital transformation. This competitive environment fosters continuous improvement and innovation, ensuring that North America remains at the forefront of supply chain analytics.

Europe : Emerging Analytics Hub

Europe's Supply Chain Data Analytics Services Market is poised for growth, with a market size of 5.0 in 2024. The region benefits from stringent regulations promoting transparency and efficiency in supply chains, alongside increasing investments in digital technologies. The demand for analytics services is driven by the need for enhanced operational efficiency and sustainability, as companies seek to comply with evolving regulations and consumer expectations.

Leading countries such as Germany, France, and the UK are at the forefront of this market, with a strong presence of key players like SAP and Oracle. The competitive landscape is marked by a mix of established firms and innovative startups, fostering a dynamic environment for growth. As European companies increasingly adopt data analytics, the region is set to solidify its position as a key player in the global market.

Asia-Pacific : Rapidly Growing Market

The Asia-Pacific region is witnessing rapid growth in the Supply Chain Data Analytics Services Market, with a market size of 3.0 in 2024. This growth is fueled by increasing digitalization, a burgeoning e-commerce sector, and rising consumer demand for faster delivery times. Governments in the region are also promoting initiatives to enhance supply chain efficiency, which further drives the adoption of analytics services across various industries.

Countries like China, India, and Japan are leading the charge, with significant investments in technology and infrastructure. The competitive landscape features both global giants and local players, creating a vibrant ecosystem for innovation. As businesses in Asia-Pacific increasingly recognize the value of data analytics, the region is set to become a major player in The Supply Chain Data Analytics Services.

Middle East and Africa : Emerging Analytics Frontier

The Middle East and Africa (MEA) region is emerging as a frontier for Supply Chain Data Analytics Services, with a market size of 2.0 in 2024. The growth is driven by increasing investments in technology and infrastructure, alongside a rising awareness of the benefits of data analytics in optimizing supply chains. Governments are also implementing policies to enhance trade efficiency, which is catalyzing the demand for analytics services in the region.

Countries such as South Africa and the UAE are leading the way, with a growing number of businesses adopting analytics solutions to improve operational efficiency. The competitive landscape is characterized by a mix of local and international players, fostering innovation and collaboration. As the region continues to develop, the demand for supply chain analytics is expected to rise significantly, positioning MEA as a key market.