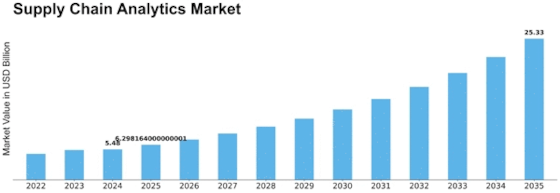

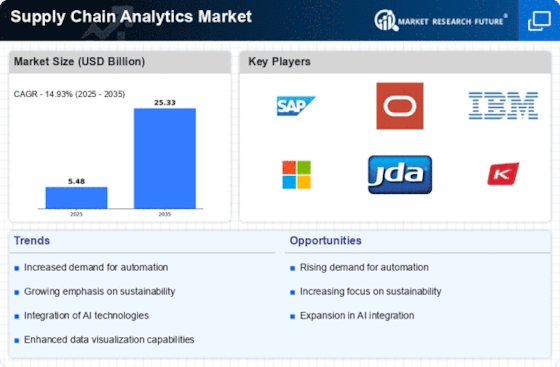

Supply Chain Analytics Size

Supply Chain Analytics Market Growth Projections and Opportunities

In the dynamic landscape of the Supply Chain Analytics Market, companies employ various market share positioning strategies to gain a competitive edge and enhance their market presence. One prominent approach is differentiation, where companies focus on offering unique and innovative solutions that set them apart from competitors. This could involve developing advanced analytics tools, implementing cutting-edge technologies, or providing tailored solutions to meet specific industry needs. By differentiating themselves, companies aim to attract a niche customer base and command a premium in the market.

Another key strategy is cost leadership, wherein companies aim to become the low-cost provider in the Supply Chain Analytics Market. This involves optimizing operational efficiency, streamlining processes, and leveraging economies of scale to offer competitive pricing. By positioning themselves as cost leaders, companies seek to appeal to a broad customer base, capturing market share through affordability and value for money. However, it's crucial to balance cost leadership with maintaining product quality and customer satisfaction to sustain long-term success.

Market segmentation is also a widely employed strategy in the Supply Chain Analytics Market. Companies divide the market into distinct segments based on factors such as industry verticals, company size, or geographic regions. By tailoring their offerings to the specific needs of each segment, companies can address diverse customer requirements effectively. This targeted approach allows businesses to establish a strong foothold in specific niches, increasing their overall market share.

Collaboration and partnerships are becoming increasingly prevalent in the Supply Chain Analytics Market. Companies recognize the value of strategic alliances to complement their strengths and fill gaps in their offerings. By partnering with other organizations, whether through joint ventures, mergers, or alliances, companies can expand their capabilities and provide end-to-end solutions to customers. This collaborative strategy not only enhances the overall value proposition but also enables companies to capture a larger share of the market by leveraging the combined strengths of multiple entities.

Adaptability and continuous innovation are critical components of successful market share positioning in the rapidly evolving Supply Chain Analytics landscape. Companies need to stay ahead of industry trends, emerging technologies, and changing customer demands. By investing in research and development, staying agile, and promptly adapting to market shifts, companies can position themselves as leaders in the Supply Chain Analytics Market. This proactive approach not only helps in maintaining market share but also opens doors to new opportunities and revenue streams.

In conclusion, market share positioning in the Supply Chain Analytics Market involves a combination of differentiation, cost leadership, market segmentation, collaboration, and adaptability. Companies must carefully craft their strategies based on a deep understanding of customer needs, industry trends, and competitive dynamics. Success in this dynamic market requires a holistic approach that encompasses product innovation, operational excellence, strategic partnerships, and a commitment to continuous improvement. As companies navigate the complexities of the Supply Chain Analytics Market, a well-executed market share positioning strategy becomes instrumental in achieving sustained growth and competitiveness.

Leave a Comment