Market Analysis

In-depth Analysis of Supply Chain Analytics Market Industry Landscape

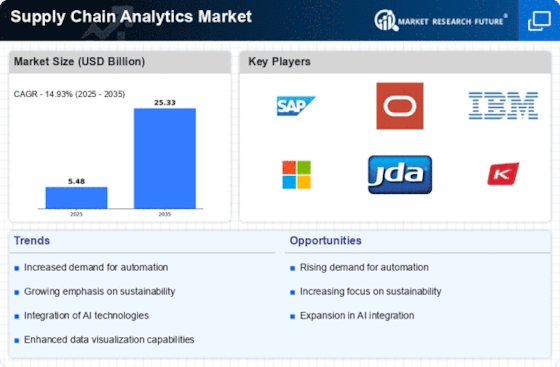

The market dynamics of the Supply Chain Analytics market are undergoing significant transformations, driven by the growing importance of data-driven decision-making in the realm of supply chain management. Supply Chain Analytics refers to the use of advanced analytical tools and techniques to extract actionable insights from the vast amounts of data generated throughout the supply chain process. As businesses increasingly recognize the pivotal role of data in optimizing operations, reducing costs, and enhancing overall efficiency, the demand for Supply Chain Analytics solutions is experiencing a substantial upswing.

One of the key drivers shaping the market dynamics is the rising complexity of global supply chains. As businesses expand their operations across borders, the intricacies of managing diverse suppliers, transportation networks, and inventory levels become more pronounced. Supply Chain Analytics provides a holistic view of the entire supply chain, enabling organizations to identify bottlenecks, forecast demand more accurately, and streamline operations. This capability is particularly crucial in mitigating risks associated with supply chain disruptions, such as those caused by geopolitical events or natural disasters.

Moreover, the increasing adoption of technologies like the Internet of Things (IoT) and Artificial Intelligence (AI) is propelling the growth of the Supply Chain Analytics market. These technologies facilitate the collection of real-time data from various sources within the supply chain, offering unparalleled visibility and insights. IoT sensors on goods in transit, for instance, can provide valuable information on location, temperature, and other environmental factors. AI algorithms can then analyze this data to optimize routes, predict maintenance needs, and enhance overall supply chain efficiency.

The market dynamics are also influenced by the rising emphasis on sustainability in supply chain management. As businesses recognize the importance of environmental and social responsibility, they are leveraging Supply Chain Analytics to assess and improve the sustainability of their operations. Analytics tools enable organizations to track and measure their carbon footprint, identify areas for improvement, and make informed decisions to align with sustainability goals. This trend is not only driven by ethical considerations but also by the growing awareness that sustainable practices can contribute to cost savings and enhanced brand reputation.

Furthermore, the competitive landscape of the Supply Chain Analytics market is witnessing a surge in partnerships and collaborations. With an increasing number of solution providers entering the market, companies are forming strategic alliances to enhance their capabilities and offer comprehensive solutions. These partnerships often involve the integration of Supply Chain Analytics platforms with other technologies, such as Enterprise Resource Planning (ERP) systems or cloud-based solutions. Such collaborations enable businesses to create end-to-end visibility and seamless connectivity across the entire supply chain ecosystem.

However, challenges exist within the market dynamics, including concerns related to data security and privacy. As organizations rely on vast amounts of sensitive data for analytics, ensuring the confidentiality and integrity of this information becomes paramount. Additionally, there is a need for skilled professionals who can interpret and act upon the insights generated by Supply Chain Analytics tools. Addressing these challenges is crucial for sustained growth in the market and the realization of the full potential of supply chain optimization.

In conclusion, the market dynamics of the Supply Chain Analytics market are characterized by a confluence of factors, including the increasing complexity of global supply chains, technological advancements, a focus on sustainability, and collaborative efforts among industry players. As businesses strive to gain a competitive edge through data-driven decision-making, the demand for advanced analytics solutions in supply chain management is expected to continue its upward trajectory, shaping the future landscape of the market.

Leave a Comment