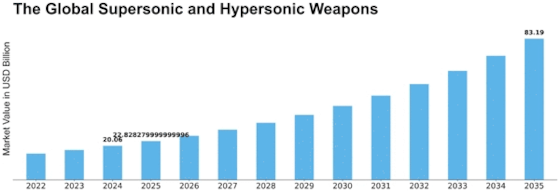

Supersonic And Hypersonic Weapons Size

Supersonic and Hypersonic Weapons Market Growth Projections and Opportunities

The supersonic and hypersonic weapons market is shaped by several key factors that drive its growth and evolution. One significant factor is the increasing emphasis on military modernization and the development of advanced weapon systems to maintain strategic superiority and address emerging security threats. With geopolitical tensions rising and potential adversaries investing in advanced military capabilities, there is a growing demand for supersonic and hypersonic weapons that offer increased speed, range, and precision to enable rapid and effective response to evolving threats. As military forces seek to enhance their strike capabilities and deterrence posture, there is a heightened interest in developing and deploying next-generation weapons systems capable of penetrating and defeating advanced air defenses.

Moreover, technological advancements play a crucial role in shaping the supersonic and hypersonic weapons market. Advances in propulsion technology, materials science, aerodynamics, and guidance systems have enabled the development of supersonic and hypersonic missiles, cruise missiles, and glide vehicles with unprecedented speed and maneuverability. These weapons leverage cutting-edge technologies, such as scramjet engines, solid-fuel rocket motors, and advanced composite materials, to achieve hypersonic speeds exceeding Mach 5 and evade enemy defenses effectively. Additionally, improvements in sensor technology, target acquisition, and precision strike capabilities enable supersonic and hypersonic weapons to deliver highly accurate and lethal payloads with minimal collateral damage, enhancing their effectiveness in modern warfare scenarios.

Furthermore, geopolitical tensions and security threats drive market demand for supersonic and hypersonic weapons systems. With increasing competition among major powers and the proliferation of advanced military technologies, there is a growing emphasis on developing and deploying weapons systems capable of penetrating enemy defenses and striking high-value targets with precision and speed. Supersonic and hypersonic weapons offer significant advantages in terms of speed, agility, and lethality, making them attractive options for military planners seeking to enhance deterrence, power projection, and strategic flexibility. Additionally, the emergence of anti-access/area denial (A2/AD) strategies and the proliferation of advanced air and missile defense systems highlight the importance of developing hypersonic weapons that can evade enemy defenses and effectively strike targets deep within adversary territory.

Additionally, market factors such as defense budgets, procurement priorities, and technological partnerships influence market dynamics in the supersonic and hypersonic weapons sector. Defense spending levels and investment priorities vary across countries and regions, depending on strategic threats, military alliances, and budget constraints. Countries with larger defense budgets and ambitious modernization programs tend to invest more heavily in acquiring and developing advanced supersonic and hypersonic weapons systems to maintain technological superiority and strategic advantage. Moreover, international collaborations and technological partnerships play a significant role in driving innovation and accelerating the development of supersonic and hypersonic weapons technologies, as defense contractors and research organizations pool resources, share expertise, and leverage complementary capabilities to overcome technical challenges and expedite program timelines.

Furthermore, the impact of emerging technologies, such as artificial intelligence (AI), directed energy weapons (DEWs), and space-based assets, is reshaping the supersonic and hypersonic weapons market. AI-driven algorithms and decision support systems enhance the performance and autonomy of hypersonic weapons, enabling autonomous targeting, trajectory optimization, and real-time threat assessment capabilities. DEWs, including laser and high-powered microwave systems, offer complementary capabilities to supersonic and hypersonic weapons, providing additional layers of defense and countermeasure against enemy air and missile threats. Additionally, space-based assets, such as satellites and reconnaissance platforms, enable real-time intelligence, surveillance, and reconnaissance (ISR) support for supersonic and hypersonic weapons operations, enhancing situational awareness and mission effectiveness in contested environments.

Moreover, market factors such as international arms control agreements, export restrictions, and regulatory frameworks influence market dynamics in the supersonic and hypersonic weapons sector. Arms control agreements, such as the Missile Technology Control Regime (MTCR) and the Strategic Arms Reduction Treaty (START), impose restrictions on the export, transfer, and proliferation of certain categories of weapons, including ballistic missiles and hypersonic glide vehicles. Additionally, export controls and regulatory frameworks govern the export licensing, technology transfer, and end-use monitoring of supersonic and hypersonic weapons systems, ensuring compliance with non-proliferation objectives and national security interests.

Leave a Comment