Market Trends

Key Emerging Trends in the Superhard Materials Market

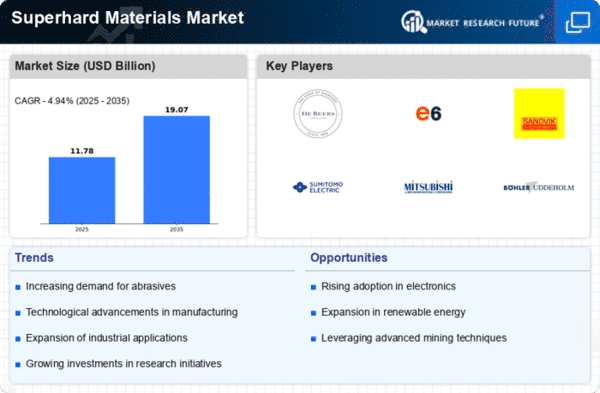

The Superhard Materials Market is currently witnessing significant trends that are transforming the industry across various applications. One noteworthy trend is the increasing demand for superhard materials in the manufacturing and cutting tools industry. Superhard materials, including synthetic diamond and cubic boron nitride (CBN), are prized for their exceptional hardness and wear resistance. In the manufacturing sector, these materials are widely used for cutting, grinding, and machining applications, contributing to enhanced productivity and tool longevity. This trend aligns with the growing emphasis on precision machining and high-performance tools in industries like aerospace, automotive, and metalworking.

Environmental sustainability is emerging as a key driver influencing market trends in the Superhard Materials Market. While natural diamonds have traditionally been used for cutting tools, there is a rising preference for synthetic diamonds due to ethical and environmental concerns associated with diamond mining. The production of synthetic diamonds offers a more sustainable and controlled alternative, addressing ethical considerations and reducing the environmental impact of mining activities. This trend reflects the industry's commitment to responsible sourcing and eco-friendly practices.

Technological advancements play a pivotal role in shaping market trends in the Superhard Materials Market. Ongoing research and development efforts focus on improving the properties and performance of superhard materials. Innovations in manufacturing processes, such as high-pressure high-temperature (HPHT) and chemical vapor deposition (CVD), contribute to the production of high-quality synthetic diamonds and CBN. These technological trends address the demand for superhard materials with enhanced characteristics, including increased hardness, thermal stability, and toughness.

The electronics and semiconductor industry is another significant influencer of market trends in the Superhard Materials Market. Superhard materials find applications in the production of cutting and polishing tools used in the manufacturing of semiconductors, LEDs, and other electronic components. The precise machining and processing capabilities of superhard materials are crucial for achieving the tolerances required in microelectronics, driving their adoption in this high-precision industry. This trend is fueled by the continuous miniaturization and advancement of electronic devices.

Supply chain dynamics and raw material costs are critical factors impacting market trends in the Superhard Materials Market. The availability and pricing of raw materials, such as high-quality diamond and boron nitride, can influence the overall cost of superhard material production. Fluctuations in raw material prices, geopolitical factors, and supply chain disruptions can pose challenges for manufacturers. Companies in the Superhard Materials Market are actively managing their supply chains, exploring alternative raw materials, and adopting strategies to ensure a stable and cost-effective production process.

Moreover, there is a growing trend towards the development of composite superhard materials. As industries seek materials with superior properties, there is a rising interest in combining different superhard materials or incorporating them into composite structures. These composite superhard materials aim to leverage the strengths of individual components, enhancing hardness, toughness, and overall performance. This trend reflects the industry's pursuit of cutting-edge solutions to meet evolving application requirements in diverse sectors.

Leave a Comment