Superhard Materials Size

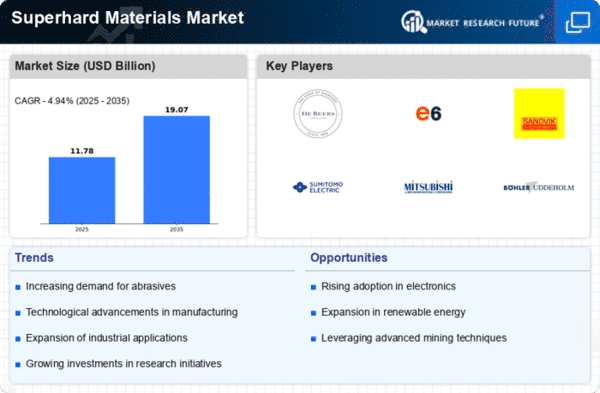

Superhard Materials Market Growth Projections and Opportunities

The Superhard Materials Market is driven by various factors that collectively shape its trends and growth trajectory. One primary driver is the demand from industries requiring cutting-edge materials for applications involving extreme wear and abrasion resistance. Superhard materials, such as synthetic diamonds and cubic boron nitride (CBN), find extensive use in manufacturing tools and components for the aerospace, automotive, and oil and gas industries. The continuous pursuit of precision engineering and the need for materials that can withstand harsh operating conditions contribute significantly to the growing demand for superhard materials.

Global economic conditions play a crucial role in influencing the Superhard Materials Market. Economic growth and industrialization contribute to increased demand for advanced materials to enhance manufacturing processes and extend the lifespan of tools and equipment. The burgeoning manufacturing sectors in developing economies further drive the market as industries seek cutting-edge solutions to improve efficiency and productivity.

Technological advancements in superhard material synthesis and manufacturing processes impact the market dynamics. Ongoing research and development efforts lead to innovations in the production of synthetic diamonds and CBN, allowing for improved hardness, toughness, and tailored properties. Companies that invest in these technological advancements gain a competitive edge by offering high-quality superhard materials that meet the evolving needs of various industries.

The automotive industry significantly contributes to the Superhard Materials Market. As automakers focus on lightweighting and manufacturing precision components for engines and transmission systems, the demand for superhard materials in the production of cutting tools, drills, and abrasives rises. Superhard materials play a critical role in enhancing the efficiency and precision of manufacturing processes in the automotive sector.

The oil and gas industry is another key driver of the Superhard Materials Market. With the need for advanced materials that can withstand the extreme conditions encountered in drilling and exploration activities, superhard materials become essential for manufacturing durable and high-performance drilling tools, bits, and components. The growing global demand for energy further amplifies the market's growth, as the oil and gas industry seeks reliable and efficient materials for exploration and production.

Geopolitical factors and trade dynamics also play a role in shaping the Superhard Materials Market. Fluctuations in trade relations, changes in tariffs, and geopolitical tensions can impact the supply chain and pricing of superhard materials. Companies in the market need to stay informed about global trade developments and adjust their strategies to navigate potential risks and capitalize on emerging opportunities in the global market.

Furthermore, the electronics and semiconductor industries contribute to the demand for superhard materials. As the demand for smaller and more efficient electronic devices grows, superhard materials find applications in the manufacturing of cutting tools for precision machining of semiconductors and electronic components. The ability of superhard materials to provide high precision and durability is crucial in these industries.

Raw material prices, particularly those of diamond and boron nitride precursors, play a role in shaping the Superhard Materials Market. Fluctuations in the costs of these raw materials impact the production costs and pricing of superhard materials. Companies in the market must implement effective supply chain strategies and cost management practices to navigate these raw material price dynamics.

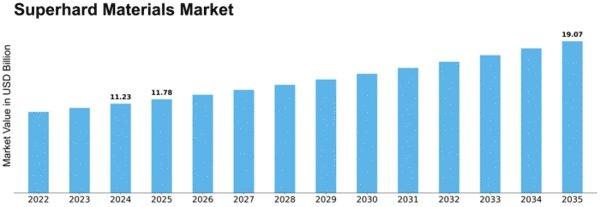

The superhard materials market size is projected to grow by 5.5% in the forecast period.

Leave a Comment