Top Industry Leaders in the Superfoods Market

Strategies Adopted by Superfoods Key Players

The Superfoods market has witnessed exponential growth in recent years, driven by increasing consumer awareness of health and wellness. As individuals become more conscious of their dietary choices, demand for nutrient-dense and functional foods has surged, propelling the superfoods market into the spotlight. This article explores the competitive landscape of the superfoods market, shedding light on key players, strategic approaches, market share factors, emerging companies, industry news, and prevailing investment trends.

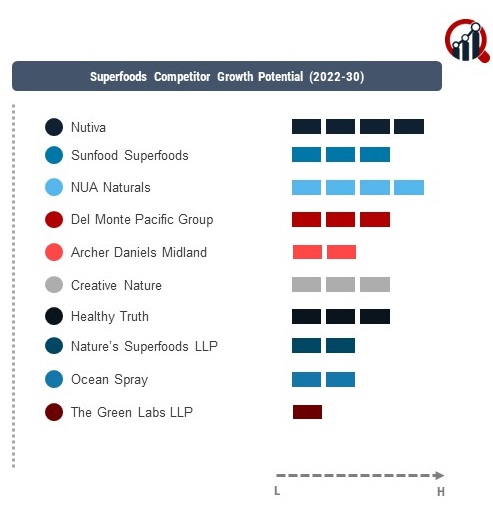

Key Players:

Nutiva

Sunfood Superfoods

NUA Naturals

Del Monte Pacific Group

Archer Daniels Midland

Creative Nature

Healthy Truth

Nature’s Superfoods LLP

Ocean Spray

The Green Labs LLP

Suncore Foods

Apax Partners

Supernutrients

Bulk Superfoods, among others

To maintain a competitive edge, key players in the superfoods market have adopted various strategies. Nestle, for instance, has focused on innovation and product development, introducing new superfood-based products that align with evolving consumer trends. Archer Daniels Midland Company has emphasized strategic partnerships and collaborations, forming alliances with local farmers and suppliers to ensure a sustainable and quality supply chain. General Mills, on the other hand, has invested heavily in marketing and branding, creating awareness about the health benefits of their superfood offerings.

Factors for Market Share Analysis: Analyzing market share in the superfoods sector involves considering various factors. Product innovation, brand reputation, distribution channels, and pricing strategies play pivotal roles in determining a company's market share. Nestle's success, for example, can be attributed to its continuous efforts in introducing innovative superfood products, while General Mills' widespread presence in retail outlets and effective marketing campaigns contribute to its market dominance.

New and Emerging Companies: The superfoods market has also witnessed the emergence of new and innovative companies seeking to carve their niche. Start-ups like Sunfood and Your Super have gained traction by focusing on organic, sustainable, and ethically sourced superfoods. These companies often differentiate themselves through unique product offerings and a commitment to transparency in their sourcing and production processes. The agility and fresh perspectives of these newcomers pose a potential challenge to established players.

Industry News: Recent developments in the superfoods market include a growing emphasis on sustainability and ethical sourcing. Consumers are increasingly concerned about the environmental impact of their food choices, prompting companies to adopt eco-friendly practices. Additionally, regulatory changes and certifications, such as organic and non-GMO labels, are influencing consumer preferences and shaping the competitive landscape. Companies that align with these trends stand to gain a competitive advantage.

Current Company Investment Trends: Investment trends in the superfoods market reflect the industry's dynamism and potential for growth. Venture capital firms are keenly investing in start-ups that focus on innovative superfood solutions, recognizing the evolving consumer demand for healthier food options. Established players are also allocating significant resources to research and development, aiming to stay ahead in the race for novel and appealing superfood offerings. This increased investment across the board signals confidence in the sustained growth of the superfoods market.

Overall Competitive Scenario: The overall competitive scenario in the superfoods market is marked by a delicate balance between established giants and nimble newcomers. While key players continue to dominate with their vast resources and market presence, new entrants are disrupting the status quo with fresh ideas and sustainable practices. Innovation remains a key driver of competitiveness, with companies striving to meet consumer demands for unique and health-focused superfood options. As the market continues to evolve, agility, adaptability, and a commitment to ethical practices will likely define success in the fiercely competitive superfoods landscape.

the superfoods market is a vibrant and dynamic sector characterized by intense competition and rapid innovation. Key players, through diverse strategies, have secured their positions, but the rise of new and emerging companies introduces an element of unpredictability. Factors such as sustainability, industry trends, and investment patterns shape the competitive landscape, making it imperative for companies to stay agile and responsive to evolving consumer preferences. As the superfoods market continues to grow, the interplay between established giants and innovative newcomers will shape the future trajectory of this flourishing industry.

Recent News :

Fruits and Berries:

- Dole Sunshine Company: Launched a new line of frozen smoothie packs featuring superfoods like açai, berries, and chia seeds, targeting convenience and health-conscious consumers.

- Pom Wonderful: Partnered with a leading online recipe platform to develop recipes and promote their pomegranate juice as a natural source of antioxidants.

Vegetables and Greens:

- Mannatech Incorporated: Introduced a new line of Superfood Greens and Reds products combining various vegetable and fruit concentrates for ultimate nutrient power.

- Nature's Way: Expanded their vegetable powder offerings with a new organic kale powder, capitalizing on the trend of green superfoods.

Nuts and Seeds:

- Blue Diamond Growers: Launched a line of flavored almonds infused with superfoods like turmeric and matcha, tapping into the trend of functional snacks.

- Quaker Oats Company: Added chia seeds to their popular granola bars, catering to consumers seeking added protein and fiber from superfoods.

Plant-Based Alternatives:

- Beyond Meat Inc.: Acquired a leading vegan chicken producer, strengthening their meat substitute portfolio and diversifying their superfood protein options.

- Nestle SA: Collaborated with a startup to develop plant-based protein powders using novel ingredients like duckweed, highlighting innovative approaches to superfood sources.

Mushroom Power:

- Sunopta Inc.: Acquired a leading organic mushroom producer, capitalizing on the growing popularity of functional mushrooms like reishi and lion's mane for their potential health benefits.

- Host Defense Mushrooms: Partnered with a research institution to study the effectiveness of their mushroom supplements, advancing scientific understanding of these superfoods.Top of Form