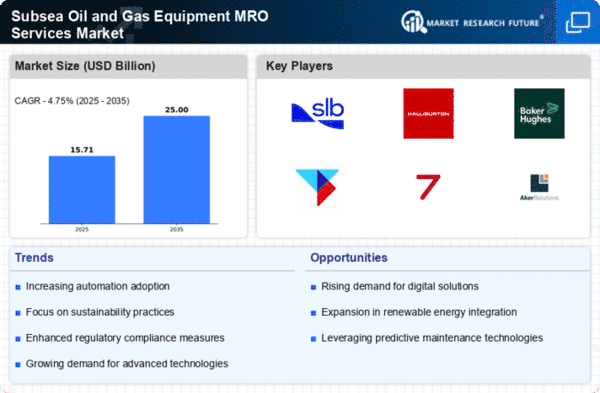

The Subsea Oil and Gas Equipment MRO Services Market is characterized by a competitive landscape that is increasingly shaped by technological advancements and strategic collaborations. Key players such as Schlumberger (US), Halliburton (US), and TechnipFMC (GB) are actively pursuing innovation and digital transformation to enhance operational efficiency and service delivery. Schlumberger (US) has focused on integrating advanced data analytics into its maintenance operations, which appears to streamline processes and reduce downtime for clients. Meanwhile, Halliburton (US) has emphasized regional expansion, particularly in emerging markets, to capitalize on the growing demand for subsea services. TechnipFMC (GB) has adopted a strategy centered around sustainability, aiming to reduce the environmental impact of its operations, which resonates well with current market trends.The business tactics employed by these companies reflect a concerted effort to optimize supply chains and localize manufacturing. The market structure is moderately fragmented, with several players vying for market share, yet the influence of major companies remains substantial. This competitive dynamic fosters an environment where innovation and operational excellence are paramount, as companies seek to differentiate themselves in a crowded marketplace.

In November Baker Hughes (US) announced a strategic partnership with a leading technology firm to develop AI-driven predictive maintenance solutions. This initiative is likely to enhance the reliability of subsea equipment, thereby reducing operational costs for clients. The integration of AI into maintenance practices could signify a pivotal shift in how MRO services are delivered, potentially setting a new standard in the industry.

In October Aker Solutions (NO) unveiled a new subsea production system designed to optimize energy efficiency and reduce emissions. This development not only aligns with global sustainability goals but also positions Aker Solutions (NO) as a frontrunner in the transition towards greener technologies in the subsea sector. The emphasis on energy-efficient solutions may attract environmentally conscious clients and enhance the company's competitive edge.

In September Oceaneering International (US) expanded its service offerings by acquiring a specialized robotics firm. This acquisition is expected to bolster Oceaneering's (US) capabilities in subsea inspection and maintenance, leveraging advanced robotics to improve operational safety and efficiency. The move reflects a broader trend of companies seeking to enhance their technological prowess through strategic acquisitions, thereby reinforcing their market positions.

As of December the competitive trends in the Subsea Oil and Gas Equipment MRO Services Market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in driving innovation. The competitive landscape is likely to evolve, with a shift from traditional price-based competition towards differentiation through technology, innovation, and supply chain reliability. This transition may redefine how companies approach market challenges and opportunities in the coming years.