Emerging Therapeutic Options

The emergence of novel therapeutic options is a key driver in the Sturge Weber Syndrome Market. Recent advancements in pharmacological treatments and surgical interventions have opened new avenues for managing the symptoms associated with Sturge Weber Syndrome. For instance, the development of targeted therapies aimed at controlling seizures and alleviating neurological deficits has shown promise in clinical settings. Additionally, surgical options such as resection of affected brain tissue are being explored as potential solutions for patients with severe manifestations of the syndrome. As these therapeutic options gain traction, they are likely to attract investment and research funding, further propelling the growth of the Sturge Weber Syndrome Market. The availability of diverse treatment modalities may also enhance patient quality of life and overall satisfaction.

Increased Awareness and Advocacy

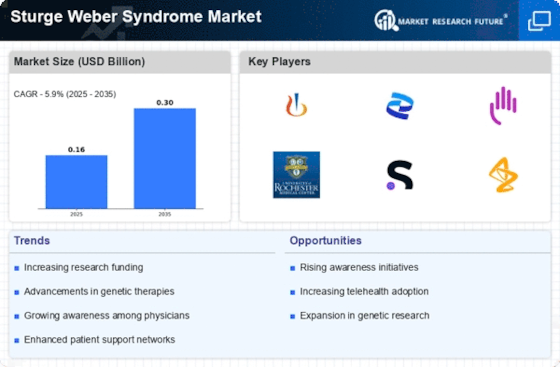

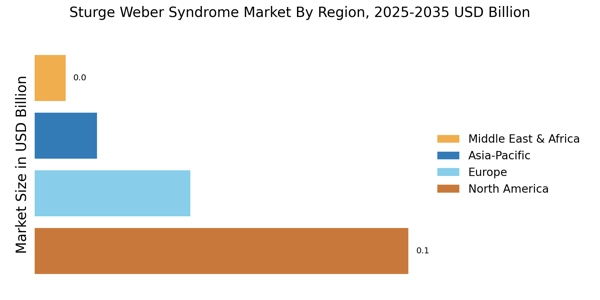

Increased awareness and advocacy for Sturge Weber Syndrome are pivotal drivers in the Sturge Weber Syndrome Market. Various organizations and patient advocacy groups are actively working to educate the public and healthcare professionals about the condition. This heightened awareness is crucial for early diagnosis and treatment, which can significantly improve patient outcomes. As more individuals become informed about Sturge Weber Syndrome, there is a corresponding rise in the number of patients seeking medical advice and intervention. This trend is likely to lead to an increase in healthcare expenditures related to the management of the syndrome, thereby stimulating growth within the Sturge Weber Syndrome Market. Furthermore, advocacy efforts may also encourage funding for research initiatives aimed at developing novel therapies.

Rising Incidence of Sturge Weber Syndrome

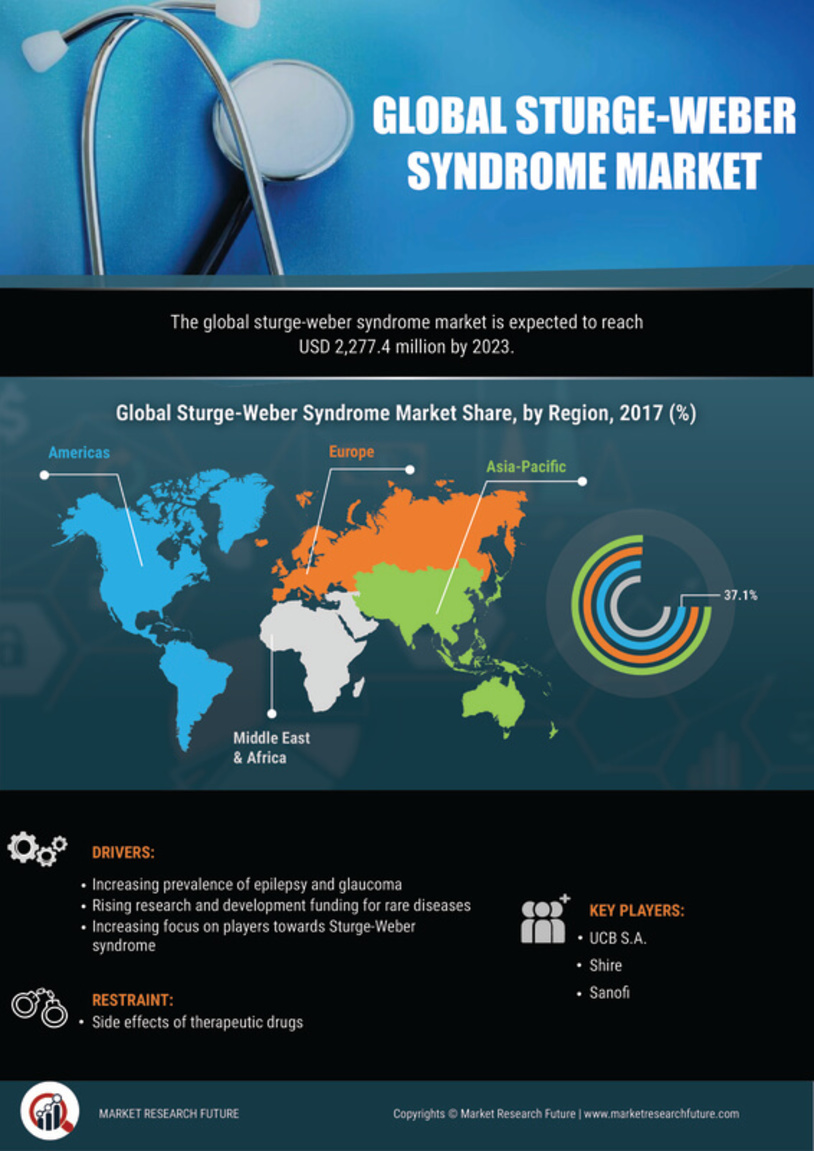

The increasing incidence of Sturge Weber Syndrome is a notable driver in the Sturge Weber Syndrome Market. Recent epidemiological studies indicate that the prevalence of this condition may be higher than previously estimated, with some reports suggesting an occurrence rate of approximately 1 in 20,000 live births. This rise in incidence necessitates enhanced awareness and diagnostic capabilities, thereby driving demand for specialized treatments and interventions. As healthcare providers become more adept at recognizing the symptoms associated with Sturge Weber Syndrome, the market is likely to see a corresponding increase in patient referrals and treatment options. Consequently, the growing patient population is expected to stimulate further research and development efforts within the Sturge Weber Syndrome Market, ultimately leading to improved therapeutic outcomes.

Technological Advancements in Imaging Techniques

Technological advancements in imaging techniques are significantly influencing the Sturge Weber Syndrome Market. Innovations such as high-resolution MRI and advanced neuroimaging modalities have enhanced the ability to diagnose and monitor Sturge Weber Syndrome more effectively. These imaging techniques allow for better visualization of the brain's vascular structures, which is crucial for understanding the extent of the condition and planning appropriate interventions. As these technologies become more accessible and affordable, healthcare providers are likely to adopt them more widely, leading to earlier diagnosis and improved patient management. This trend not only benefits patients but also drives the growth of the Sturge Weber Syndrome Market by increasing the demand for imaging services and related diagnostic tools.

Collaboration Between Research Institutions and Pharmaceutical Companies

Collaboration between research institutions and pharmaceutical companies is increasingly shaping the Sturge Weber Syndrome Market. These partnerships are essential for driving innovation and accelerating the development of new therapies. By pooling resources and expertise, stakeholders can conduct more comprehensive studies and clinical trials, which are crucial for understanding the complexities of Sturge Weber Syndrome. Such collaborations may lead to the identification of novel drug candidates and treatment protocols that can significantly improve patient outcomes. Furthermore, as these partnerships become more prevalent, they are likely to enhance the overall research landscape, fostering a more robust pipeline of therapeutic options within the Sturge Weber Syndrome Market. This synergy between academia and industry is expected to yield substantial benefits for patients and healthcare providers alike.