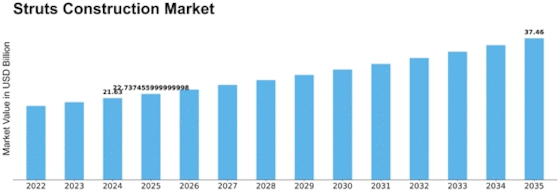

Struts Construction Size

Struts Construction Market Growth Projections and Opportunities

Struts construction market dynamics are shaped by many things. Economy is a major market component. Economic stability and growth boost construction, increasing strut demand. In a recession, construction projects may be postponed or cut back, affecting the struts market.

Government laws and regulations shape the struts building market. Building codes, safety requirements, and environmental regulations affect building project design and specifications, affecting strut type and amount. These requirements might benefit or hurt struts manufacturers and suppliers.

Construction technology is another important market component. Changing materials, design, and production methods can affect strut demand. Companies that adopt new technologies may have a market advantage. Conversely, personnel that cannot adapt may struggle to meet building project needs.

The struts construction market is affected by raw material availability and cost. Price fluctuations in steel, aluminum, and other strut manufacturing materials can affect production costs and product pricing. Geopolitical considerations, trade restrictions, and supply chain disruptions can affect global raw material sourcing, which can affect the struts market.

Strut demand depends on regional infrastructure development. Growing urbanization and infrastructure developments like highways, bridges, and commercial buildings require struts for structural support. Strut demand may rise in metropolitan areas with rapid urban growth and fall in locations with sluggish or deteriorating infrastructure.

Environmental and sustainability issues are growing in the building business. Climate change and environmental consciousness are driving demand for eco-friendly and energy-efficient construction materials. Sustainable and green strut producers may have an advantage in the market.

Competition in the market also matters. Supplier numbers, market share, and competition in the truss construction market affect pricing, innovation, and industry dynamics. Research and development, customer service, and strategic collaborations may help companies compete.

Finally, global and macroeconomic developments can greatly effect the structural construction business. Natural disasters, economic crises, and geopolitical conflicts can disrupt construction projects, hurting strut demand. Population expansion, demographic fluctuations, and consumer tastes can also affect construction projects and the struts market.

Leave a Comment