North America : Market Leader in Consulting Services

North America continues to lead the Structured Finance Consulting Services market, holding a significant share of 7.5 in 2024. The region's growth is driven by robust demand for innovative financial solutions, regulatory compliance, and risk management services. The presence of major financial institutions and a strong regulatory framework further catalyze market expansion, making it a hub for structured finance activities.

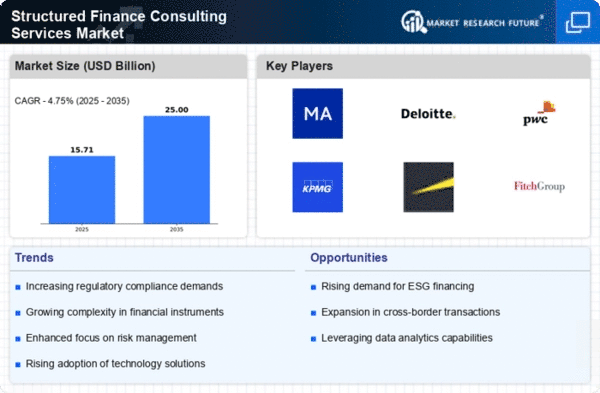

The competitive landscape is characterized by key players such as Moody's Analytics, Deloitte, and PwC, which dominate the market with their comprehensive service offerings. The U.S. remains the leading country, supported by a favorable business environment and advanced technological infrastructure. This region's focus on digital transformation and data analytics is expected to enhance service delivery and client engagement, solidifying its market position.

Europe : Emerging Market with Growth Potential

Europe's Structured Finance Consulting Services market is valued at 4.5, reflecting a growing demand for tailored financial solutions. The region is witnessing increased regulatory scrutiny and a push for transparency, which are driving the need for consulting services. Factors such as economic recovery and investment in infrastructure projects are also contributing to market growth, making it a vital area for structured finance.

Leading countries like the UK, Germany, and France are at the forefront, with firms such as KPMG and EY playing significant roles. The competitive landscape is evolving, with a mix of established players and emerging firms. The European market is characterized by a strong emphasis on sustainability and ESG compliance, which is reshaping service offerings and client expectations. "The European financial market is adapting to new regulatory standards, enhancing the demand for specialized consulting services," European Banking Authority.

Asia-Pacific : Rapidly Growing Financial Sector

The Asia-Pacific region, with a market size of 2.5, is rapidly emerging as a significant player in the Structured Finance Consulting Services market. The growth is fueled by increasing foreign investments, urbanization, and a rising middle class demanding sophisticated financial products. Regulatory reforms aimed at enhancing market stability and transparency are also contributing to the demand for consulting services in this region.

Countries like China, India, and Australia are leading the charge, with a mix of local and international firms competing for market share. Key players such as Accenture and Oliver Wyman are expanding their presence, focusing on innovative solutions tailored to regional needs. The competitive landscape is dynamic, with a strong emphasis on technology adoption and digital transformation, positioning the region for sustained growth.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region, with a market size of 0.5, presents untapped opportunities in the Structured Finance Consulting Services market. The growth is driven by increasing investments in infrastructure and a burgeoning financial sector. Regulatory initiatives aimed at enhancing financial stability and attracting foreign investment are also key growth drivers, creating a favorable environment for consulting services.

Countries like the UAE and South Africa are leading the market, with a growing number of local and international firms entering the space. The competitive landscape is evolving, with a focus on building local expertise and adapting global best practices. The region's unique challenges and opportunities require tailored consulting solutions, making it a promising area for growth. "The financial landscape in the Middle East is evolving, presenting new opportunities for consulting services," International Monetary Fund.