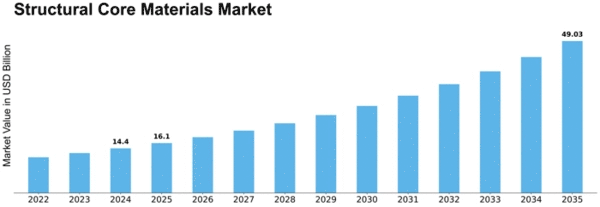

Structural Core Materials Size

Structural Core Materials Market Growth Projections and Opportunities

Structural core materials play a crucial role in various industries, including aerospace, marine, automotive, and construction. The market factors influencing these materials are multifaceted and encompass a range of considerations. One of the primary determinants is the growing demand for lightweight materials across industries. As industries aim for enhanced fuel efficiency, increased payload capacities, and improved performance, the need for lighter yet sturdy materials becomes paramount. This demand directly impacts the market for structural core materials, propelling research and development efforts to create innovative, lightweight solutions that maintain structural integrity.

The global market for Structural Core Materials estimated at US$1.10 Billion in the year 2021, is projected to reach a revised size of US$2.12 Billion by 2030, growing at a CAGR of 5% over the analysis period 2021-2030.

Moreover, environmental concerns and regulations significantly influence the market dynamics of structural core materials. With an increasing focus on sustainability and reducing carbon footprints, industries are actively seeking eco-friendly alternatives. Materials that offer high strength-to-weight ratios while being recyclable and possessing a lower environmental impact are gaining traction in the market. Manufacturers are thus compelled to invest in sustainable production methods and materials to align with these evolving environmental standards.

Another pivotal market factor for structural core materials is technological advancements. Continuous innovations in manufacturing processes, such as advanced composite manufacturing techniques and nanotechnology, have led to the development of more efficient and durable materials. These advancements not only enhance the performance characteristics of structural core materials but also contribute to cost-effectiveness by streamlining production processes and reducing material waste.

The global economic landscape also significantly influences the market for structural core materials. Factors like economic stability, fluctuations in raw material prices, and global trade policies impact the cost of production and ultimately the pricing of these materials. For instance, changes in tariffs or trade agreements can affect the availability and cost of raw materials required for manufacturing structural cores, thereby impacting the overall market dynamics.

Furthermore, the end-user industries play a crucial role in shaping the demand for structural core materials. For example, the aerospace industry requires materials that meet stringent safety standards and possess exceptional strength-to-weight ratios to enhance aircraft performance. Similarly, the marine industry seeks materials that offer resistance to harsh environmental conditions like saltwater corrosion. Each industry's specific requirements drive the research and development of tailored structural core materials, leading to diverse market offerings to cater to varied industry needs.

Additionally, market factors related to consumer preferences and trends cannot be overlooked. Consumer preferences for products with better aesthetics, increased durability, and higher performance influence the choices made by manufacturers in selecting structural core materials. As consumer awareness regarding sustainability grows, there is a rising preference for products made from eco-friendly materials, further impacting the market trends for structural core materials.

Leave a Comment