Urbanization Trends

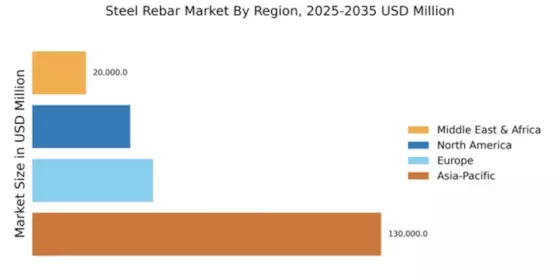

Rapid urbanization is a pivotal driver for the Global Steel Rebar Market Industry. As populations migrate towards urban centers, the need for residential and commercial buildings escalates, leading to increased demand for construction materials, particularly steel rebar. In many developing nations, urbanization rates are projected to exceed 50% by 2035, necessitating significant investments in housing and infrastructure. This urban expansion not only fuels the demand for steel rebar but also influences its pricing dynamics. The anticipated growth in urban areas is expected to contribute to the market's expansion, with projections indicating a market value of 382.2 USD Billion by 2035.

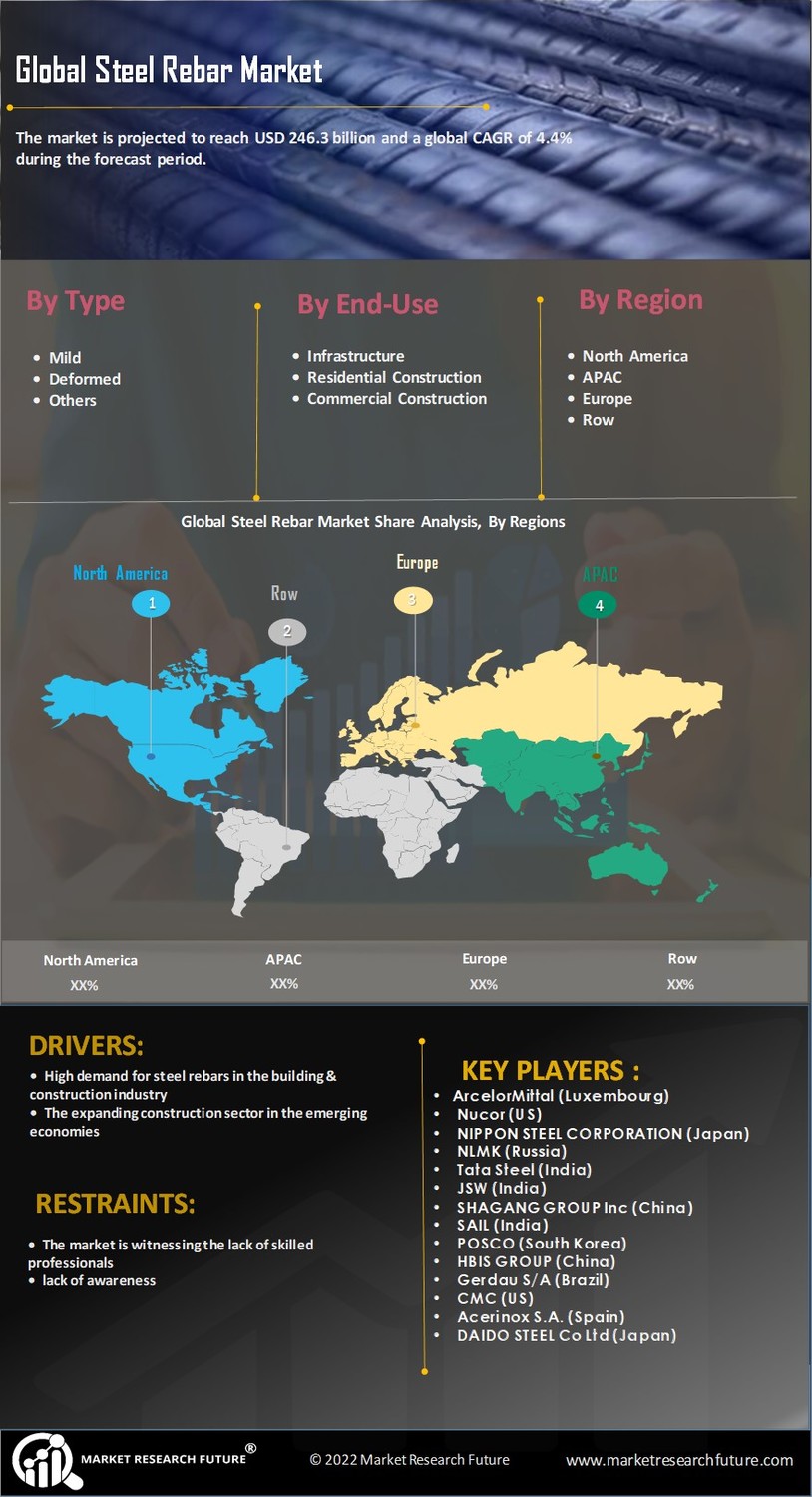

Market Growth Projections

The Global Steel Rebar Market Industry is poised for substantial growth, with projections indicating a market value of 382.2 USD Billion by 2035. This growth is underpinned by a compound annual growth rate (CAGR) of 4.16% from 2025 to 2035, reflecting a steady increase in demand driven by various factors, including infrastructure development, urbanization, and technological advancements. The market's expansion is likely to attract investments and foster innovation, as stakeholders seek to capitalize on emerging opportunities. As the industry evolves, it is essential to monitor these growth projections to understand the future landscape of the steel rebar market.

Regulatory Frameworks and Standards

The Global Steel Rebar Market Industry is significantly influenced by regulatory frameworks and standards that govern construction practices. Governments worldwide are implementing stringent regulations to ensure safety, sustainability, and quality in construction materials. Compliance with these standards often necessitates the use of high-grade steel rebar, which can withstand environmental stresses and enhance structural longevity. As regulations evolve, manufacturers are compelled to innovate and improve their product offerings, thereby driving market growth. This regulatory landscape not only shapes the demand for steel rebar but also encourages investment in research and development to meet emerging standards.

Infrastructure Development Initiatives

The Global Steel Rebar Market Industry is currently experiencing a surge due to extensive infrastructure development initiatives worldwide. Governments are investing heavily in transportation networks, bridges, and urban development projects, which require substantial quantities of steel rebar. For instance, the global infrastructure spending is projected to reach approximately 244.2 USD Billion in 2024, indicating a robust demand for construction materials. This trend is likely to continue, as many countries prioritize infrastructure as a means to stimulate economic growth. Consequently, the demand for steel rebar is expected to rise, bolstering the market's growth trajectory.

Sustainability and Eco-friendly Practices

Sustainability is becoming increasingly crucial in the Global Steel Rebar Market Industry as stakeholders prioritize eco-friendly practices. The construction sector is under pressure to reduce its carbon footprint, leading to a growing demand for recycled steel rebar and sustainable production methods. Initiatives aimed at promoting green building practices are gaining traction, with many projects now requiring the use of environmentally friendly materials. This shift towards sustainability is expected to influence market dynamics, as companies that adopt eco-friendly practices may gain a competitive edge. The emphasis on sustainability could potentially reshape the market landscape in the coming years.

Technological Advancements in Construction

Technological advancements in construction methods are reshaping the Global Steel Rebar Market Industry. Innovations such as prefabrication and advanced reinforcement techniques enhance the efficiency and effectiveness of rebar usage in construction projects. These technologies not only reduce material waste but also improve structural integrity, making them attractive to builders and contractors. As the industry embraces these advancements, the demand for high-quality steel rebar is likely to increase. Furthermore, the integration of smart technologies in construction is expected to drive the market forward, as stakeholders seek to optimize resource utilization and enhance project outcomes.