Growing Importance of Disaster Preparedness

The Standby Telecom Generator Market is increasingly shaped by the growing importance of disaster preparedness. Natural disasters and extreme weather events can severely disrupt telecommunications services, making it essential for companies to have reliable backup power solutions in place. The heightened awareness of these risks has led to a proactive approach in investing in standby generators. Companies are recognizing that having a robust power backup system is not just a regulatory requirement but a critical component of their operational strategy. This trend is expected to drive further growth in the standby generator market as organizations prioritize resilience in their infrastructure.

Increasing Demand for Reliable Power Supply

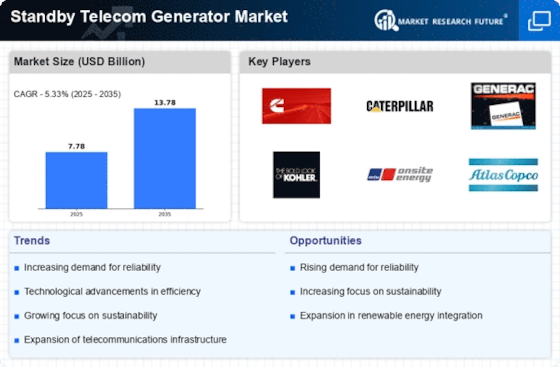

The Standby Telecom Generator Market is experiencing a notable surge in demand for reliable power supply solutions. As telecommunications infrastructure expands, the need for uninterrupted service becomes paramount. This demand is driven by the increasing reliance on digital communication and data services, which necessitate consistent power availability. According to recent data, the market for standby generators in the telecom sector is projected to grow at a compound annual growth rate of approximately 6% over the next five years. This growth is indicative of the industry's recognition of the critical role that standby generators play in maintaining operational continuity and service reliability.

Rising Adoption of Renewable Energy Sources

The Standby Telecom Generator Market is witnessing a shift towards the adoption of renewable energy sources. As environmental concerns gain prominence, telecom companies are increasingly integrating solar and wind energy into their operations. This transition not only aligns with sustainability goals but also enhances the resilience of power supply systems. The incorporation of hybrid systems, which combine traditional generators with renewable sources, is becoming more prevalent. This trend is expected to drive innovation in standby generator technology, potentially leading to more efficient and eco-friendly solutions that cater to the evolving needs of the telecom sector.

Technological Innovations in Generator Design

The Standby Telecom Generator Market is benefiting from rapid technological innovations in generator design. Manufacturers are increasingly focusing on developing advanced generators that offer improved efficiency, reduced emissions, and enhanced performance. Innovations such as smart monitoring systems and automated controls are becoming standard features, allowing for better management of power resources. These advancements not only improve the reliability of standby generators but also align with regulatory standards aimed at reducing environmental impact. As technology continues to evolve, the market is likely to see a shift towards more sophisticated and user-friendly generator solutions.

Expansion of Telecommunications Infrastructure

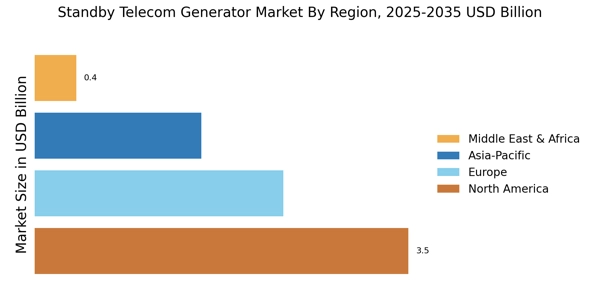

The Standby Telecom Generator Market is significantly influenced by the ongoing expansion of telecommunications infrastructure. With the proliferation of mobile networks and the rollout of 5G technology, there is an escalating need for robust power solutions to support these advancements. The market is projected to see substantial investments in infrastructure development, which will, in turn, drive the demand for standby generators. Recent estimates suggest that The Standby Telecom Generator Market could reach USD 1 trillion by 2026, highlighting the critical role of standby generators in ensuring that these systems operate without interruption.