Spring Water Size

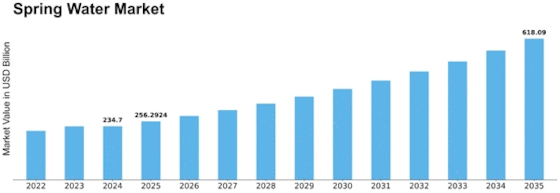

Spring Water Market Growth Projections and Opportunities

The Spring Water Market is influenced by a variety of market factors that collectively shape its dynamics, growth, and trends. One significant factor contributing to the market's success is the increasing consumer awareness and preference for healthier beverage choices. As more individuals prioritize their well-being, spring water, known for its natural purity and mineral content, has gained popularity as a healthier alternative to sugary and artificially flavored drinks.

Environmental considerations have also played a crucial role in shaping the Spring Water Market. With a growing emphasis on sustainability and eco-friendly practices, consumers are seeking water sources that align with their environmental values. Spring water, often perceived as a more sustainable option compared to some bottled waters, is sourced naturally from underground springs, reducing the environmental impact associated with extraction and packaging.

The importance of convenience in modern lifestyles is another market factor driving the demand for spring water. Packaged in various formats such as bottles and cans, spring water provides a portable and accessible hydration solution for consumers on the go. The convenience factor is particularly appealing to individuals with active lifestyles, contributing to the market's growth as a practical and easily accessible beverage option.

Government regulations and standards also play a critical role in shaping the Spring Water Market. Stringent quality and safety regulations ensure that spring water products meet specific standards for purity and are safe for consumption. These regulations not only safeguard consumer health but also contribute to building trust in the market. Companies operating in the spring water sector must adhere to these regulations, ensuring that their products meet the required quality and safety benchmarks.

Technological advancements in packaging and distribution have had a notable impact on the market dynamics of spring water. Innovations in packaging materials, such as lightweight and eco-friendly materials, contribute to reducing the environmental footprint of bottled water. Additionally, advancements in distribution logistics have improved the efficiency of getting spring water products to consumers, contributing to the market's accessibility and widespread availability.

The competitive landscape is a crucial market factor that influences the Spring Water Market. With numerous brands vying for consumer attention, companies engage in marketing strategies to differentiate their products. Branding, advertising, and promotional activities play a significant role in shaping consumer perceptions and influencing purchasing decisions. Companies often leverage their water source's unique characteristics, such as the specific mineral composition of the spring, to create a distinctive brand image.

Economic factors also contribute to the market dynamics of spring water. The purchasing power of consumers, economic stability, and disposable income levels impact the demand for premium bottled water products, including spring water. Economic fluctuations can influence consumer spending habits, affecting the market's growth trajectory.

Cultural and lifestyle trends further contribute to the Spring Water Market's evolution. The association of spring water with a healthier lifestyle has made it a choice for those seeking wellness and fitness. Additionally, cultural shifts towards sustainability and ethical consumption influence consumer choices, with more individuals opting for products and brands that align with their values.

Leave a Comment