- Q2 2024: Medtronic launches new Hugo™ robotic-assisted surgery system in U.S. Medtronic announced the commercial launch of its Hugo™ robotic-assisted surgery system in the United States, marking a significant expansion of its surgical robotics portfolio in North America.

- Q2 2024: Stryker acquires OrthoSensor to expand digital surgery capabilities Stryker completed the acquisition of OrthoSensor, a company specializing in sensor technology for orthopedic surgery, to enhance its digital surgery and data analytics offerings.

- Q1 2024: Johnson & Johnson MedTech receives FDA clearance for Velys™ digital surgery platform Johnson & Johnson MedTech announced FDA clearance for its Velys™ digital surgery platform, enabling advanced planning and navigation for orthopedic procedures in the U.S. market.

- Q2 2024: Zimmer Biomet appoints new CEO to drive North American surgical business Zimmer Biomet named a new Chief Executive Officer, signaling a strategic focus on expanding its surgical equipment business in the Americas.

- Q3 2024: Boston Scientific opens new manufacturing facility in Costa Rica for surgical devices Boston Scientific inaugurated a new manufacturing facility in Costa Rica dedicated to producing advanced surgical equipment for the Americas market.

- Q2 2024: Intuitive Surgical secures major hospital contract in Brazil for da Vinci systems Intuitive Surgical won a multi-year contract to supply its da Vinci robotic surgical systems to a leading hospital network in Brazil, expanding its presence in Latin America.

- Q1 2024: Aspen Surgical acquires Symmetry Surgical to broaden product portfolio Aspen Surgical announced the acquisition of Symmetry Surgical, strengthening its position in the surgical instruments market across the Americas.

- Q2 2024: Teleflex receives Health Canada approval for new surgical stapler Teleflex received regulatory approval from Health Canada for its latest surgical stapler, allowing commercial distribution throughout Canada.

- Q1 2024: CONMED Corporation closes $150M funding round to expand surgical device R&D CONMED Corporation completed a $150 million funding round aimed at accelerating research and development of new surgical equipment for the Americas market.

- Q2 2024: Becton Dickinson launches new minimally invasive surgical instrument line in U.S. Becton Dickinson (BD) introduced a new line of minimally invasive surgical instruments, targeting hospitals and ambulatory surgery centers across the United States.

- Q3 2024: Medtronic partners with Mayo Clinic to develop AI-powered surgical navigation tools Medtronic entered a strategic partnership with Mayo Clinic to co-develop artificial intelligence-powered navigation tools for use in complex surgical procedures.

- Q2 2024: Johnson & Johnson MedTech opens new innovation center in Texas Johnson & Johnson MedTech opened a new innovation center in Texas focused on developing next-generation surgical equipment and training healthcare professionals in advanced surgical techniques.

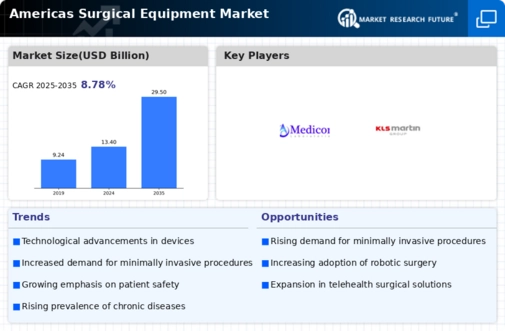

Key Players Some of the key players in this market are: Smith & Nephew (UK), B. Braun Melsungen AG (Germany), Ethicon US, LLC. (US), Erbe Elektromedizin GmbH (Germany), COVIDIEN (US), CONMED Corporation (US), MEDICON (US), Integra LifeSciences Corporation (US), Synergetics USA, Inc. (US), Stryker Corporation (US), KARL STORZ & Co. (US), and KLS Martin (Germany).

Americas Surgical Equipment Market Segment Insights

Americas Surgical Equipment Market Product Type

On the basis of product type, the market is segmented into surgical sutures & staplers, handheld instruments, electrosurgical devices, electrosurgical generators, monitoring devices and others. Surgical sutures & staplers are further segmented into absorbable and non-absorbable sutures. Handheld Instruments are subsegmented into forceps, sutures, visual scope, and others. Electrosurgical devices are further categorised into Electrosurgical instruments (HET bipolar system, electrosurgical pencils, smoke evacuation system and other), and electrosurgical generators.

Americas Surgical Equipment Market Application Insights

On the basis of application, the market is segmented into neurosurgery, wound closure, urology, cardiovascular surgeries, orthopedic surgery and others.

Americas Surgical Equipment Market End User Insights

On the basis of end user, the market is segmented into government hospitals, private hospital and other.

Americas Surgical Equipment Market Regional Insights

America surgical equipment market is expecting a healthy growth owing to introduction of advanced devices, increasing number of healthcare organization, and rising geriatric population. In addition to this, increasing prevalence of diseases & disorder, government initiatives and high healthcare spending have fuelled the market growth. According to Centers for Disease Control and Prevention, in 2012, about half of all adults had one or more chronic health conditions and one in four adults had two or more chronic health conditions.

Additionally, presence of huge patient suffering from cardiovascular diseases have also supported the growth of the market. North America holds the major share in the Americas surgical equipment market. Well-developed healthcare infrastructure and huge geriatric population in North America drives the market in this region. The US and Canada are the two major contributor for the North America surgical equipment market. However, South America has the least but growing market.

Intended Audience

- Surgical Equipment Suppliers

- Surgical Equipment Manufacturers

- Medical Research Laboratories

- Medical Devices Companies

- Academic Medical Institutes and Universities