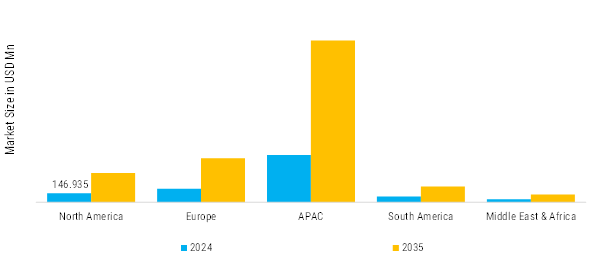

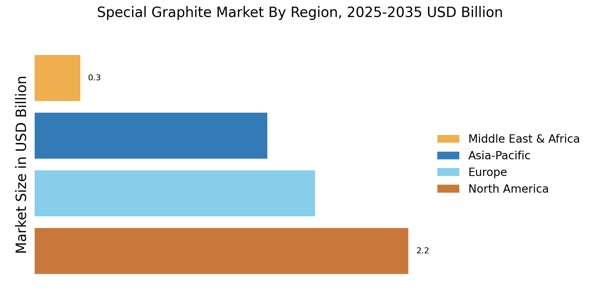

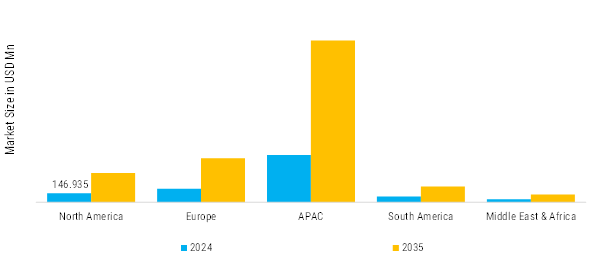

North America: Mature Technology Market with Stable Qualification-Led Demand

North America is one of the most established and functionally mature markets for special graphite, strongly reinforced by large-scale ecosystems in semiconductors, aerospace, automotive electrification, and advanced industrial heating. The region’s demand is structurally supported by a continuous pipeline of high-purity synthetic and isotropic graphite grades used in SiC/Si/GaN crystal growth, EV battery anodes, precision motor components, EDM, refractories, and furnace hot-zones. Strict environmental and industrial efficiency regulations, government-backed chip-manufacturing incentives, and low-carbon procurement frameworks encourage the adoption of energy-efficient graphitization, ultra-high-purity grades, and coated specialty graphite formulations. The presence of major OEMs in EVs, aerospace, and electronics, high R&D activity, strong recycling loops for machining scrap, and well-built aftermarket industrial hardware supply chains sustain unending graphite consumption. Additionally, nuclear, hydrogen, and grid-scale storage investments are steadily increasing demand for low-impurity, oxidation-resistant, and high-cycle reliability special graphite in the region.

Europe: Regulation-Heavy Market Driven by Emission, Efficiency & Traceability Standards

Premium, high-purity, and application-engineered special graphite grades are setting structural trends in Europe, largely due to regulatory frameworks focused on industrial emissions, fuel-efficiency hardware, battery passports, and material traceability. Demand is driven by semiconductor and solar PV manufacturing, EV/BESS expansion, carbon-efficient metallurgy, refractories, hydrogen fuel-cells, and high-temperature industrial furnaces, all of which require low thermal expansion, high conductivity, density uniformity, and extended service life. The market is dominated by synthetic and medium-to-high purity machined/isostatic graphite, while recycled and bio-attributed carbon feedstock integration is growing steadily. Well-built qualification pipelines with OEM-recommended grades, strong acceptance of supplier product declarations (low-carbon and electronics-grade purity), and Europe’s leadership in advanced automotive, battery, and electronics manufacturing jointly promote continuous innovation, high-quality purification routes, and premium graphite adoption without compromising thermal shock, oxidation resistance, or structural reliability.

Asia-Pacific: Largest & Fastest-Scaling Consumption and Manufacturing Hub

Asia-Pacific has emerged as the largest special graphite market, primarily driven by unmatched scale-ups in EV battery gigafactories, solar PV ingot manufacturing, semiconductor crystal growth, metallurgy, industrial heating, and carbon hardware machining clusters. Demand for synthetic, fine-grain, ultra-fine, and high-purity graphite grades is extremely quantifiable, driven by both OEM material consumption and high-throughput aftermarket industrial hardware replacements. China, India, Japan, South Korea, and Southeast Asia are core contributors, as rapid electrification, wafer and ingot manufacturing capacity additions, rising VKT-like process throughput (battery cycles, furnace hours), and component-life awareness accelerate graphite adoption. Investments in localized purification, high-yield machining, coated anode-grade graphite, and renewable-powered graphitization assets are scaling aggressively. Additionally, government-led mobility electrification roadmaps, grid storage targets, and industrial decarbonization programs are enabling growth of battery-anode grades, thermal-management graphite, recycled secondary streams, and eco-aligned specialty graphite portfolios across the region.

South America: Developing Industrial Market Supported by Infrastructure & Electrification Hardware Growth

South America is a steadily developing market for special graphite, driven by growth in renewable infrastructure hardware, metallurgy, refractories, automotive electrification, industrial furnaces, and emerging battery material supply loops. The largest share of graphite consumption stems from refractories, carbon products, medium-purity industrial graphite parts, and increasing synthetic fine-grain grades for EV and solar manufacturing hardware. Market uptake is influenced by macroeconomic conditions, trade policies, and import-linked price volatility, but expanding vehicle ownership (EVs, buses, logistics fleets), grid storage planning, and infrastructure connectivity for industrial heating are strengthening material qualification pipelines. Increasing awareness of thermal performance, furnace component durability, and battery cycle-life stability is gradually shifting demand from low-purity industrial graphite toward medium-to-high purity, coated, semi-machined, and synthetic specialty grades, supporting portfolio premiumization and more stable long-term consumption.

Middle East & Africa (MEA): Emerging High-Temperature & Energy-Transition Hardware Market

The MEA special graphite market is shaped by extreme operating environments (heat, dust, high furnace load), rapid infrastructure build-outs, increasing electrified vehicle sales, hydrogen hardware interest, and gradual localization of industrial heating and battery material supply chains. There is strong quantifiable demand for synthetic and medium-to-high purity graphite grades used in solar PV hot-zones, EV/BESS anodes, e-motor brushes, bearings, industrial insulation, refractories, continuous casting, and hydrogen fuel-cell bipolar plates that must withstand extreme heat, thermal shock, and oxidation risk. While mineral-like low-purity graphite still dominates commercial refractories and bulk metallurgy, synthetic fine-grain and coated high-purity grades are scaling steadily in performance-heavy and qualification-driven segments. Market growth is structurally supported by urbanization, industrial heating clusters, fleet electrification, and sustainability-aligned procurement, though economic variability and import dependency can influence price stability. Investments that improve local purification, scrap recycling, high-density graphite hardware approvals, and thermal-efficient specialty grades are creating incremental high-margin and future-aligned product demand across MEA.