Expansion of Automotive Aftermarket

The Spark Plug Market is poised for growth due to the expansion of the automotive aftermarket. As vehicle ownership increases, the need for replacement parts, including spark plugs, is also on the rise. The aftermarket segment is projected to witness substantial growth, driven by the increasing average age of vehicles on the road. Older vehicles often require more frequent maintenance, including spark plug replacements, which presents a lucrative opportunity for manufacturers. Additionally, the rise of e-commerce platforms has made it easier for consumers to access replacement spark plugs, further fueling market growth. This trend suggests that the spark plug market will continue to thrive as more consumers seek reliable and efficient replacement options for their vehicles.

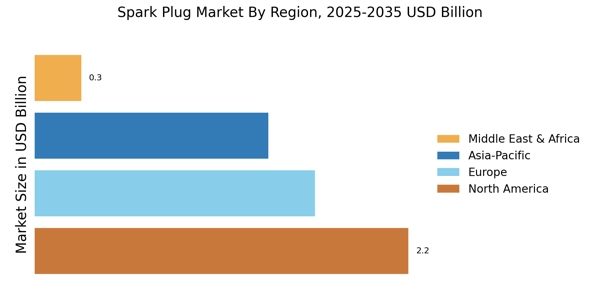

Increasing Vehicle Production Rates

The Spark Plug Market is directly impacted by increasing vehicle production rates across various segments. As automotive manufacturers ramp up production to meet consumer demand, the need for spark plugs rises correspondingly. Recent statistics indicate that vehicle production is on an upward trajectory, particularly in emerging markets where automotive sales are booming. This surge in production not only drives demand for spark plugs but also encourages manufacturers to innovate and improve their product offerings. The competition among automakers to produce high-performance vehicles is likely to result in a greater emphasis on advanced spark plug technologies, further propelling market growth. Consequently, the spark plug market is expected to benefit from the overall expansion of the automotive industry.

Rising Demand for Fuel-Efficient Vehicles

The Spark Plug Market is significantly influenced by the rising demand for fuel-efficient vehicles. As consumers become more environmentally conscious, the automotive sector is responding by developing vehicles that maximize fuel efficiency. Spark plugs play a critical role in this equation, as they are essential for optimal combustion and engine performance. The market for spark plugs is expected to expand as manufacturers focus on producing vehicles that meet stringent fuel economy standards. According to recent data, the demand for fuel-efficient vehicles has surged, leading to an increase in the production of advanced spark plugs designed to enhance combustion efficiency. This trend indicates a robust growth trajectory for the spark plug market, as automakers prioritize technologies that contribute to lower emissions and improved fuel economy.

Regulatory Compliance and Emission Standards

The Spark Plug Market is significantly shaped by regulatory compliance and stringent emission standards imposed by governments worldwide. As environmental concerns escalate, regulatory bodies are enforcing stricter guidelines on vehicle emissions, compelling manufacturers to adopt technologies that reduce pollutants. Spark plugs are integral to achieving these emission standards, as they directly influence combustion efficiency. The market for spark plugs is likely to grow as automakers invest in advanced spark plug technologies that facilitate compliance with these regulations. Furthermore, the increasing focus on reducing greenhouse gas emissions is expected to drive innovation in spark plug design, leading to products that not only meet regulatory requirements but also enhance overall vehicle performance. This regulatory landscape presents both challenges and opportunities for the spark plug market.

Technological Advancements in Spark Plug Design

The Spark Plug Market is experiencing a notable transformation due to technological advancements in spark plug design. Innovations such as iridium and platinum spark plugs are gaining traction, offering enhanced performance and longevity. These advanced materials can withstand higher temperatures and pressures, which is crucial for modern engines. The market for high-performance spark plugs is projected to grow, driven by the increasing demand for efficient fuel combustion and reduced emissions. Furthermore, the integration of smart technologies in spark plugs, such as sensors that monitor engine performance, is likely to revolutionize the industry. This shift towards more sophisticated spark plug designs not only improves engine efficiency but also aligns with the automotive industry's broader goals of sustainability and performance optimization.