Rising Cyber Threats

The wireless lan-security market in Spain is experiencing heightened demand due to the increasing frequency and sophistication of cyber threats. Organizations are recognizing the necessity of robust security measures to protect sensitive data and maintain operational integrity. In 2025, it is estimated that cybercrime could cost businesses globally over $10 trillion annually, prompting Spanish companies to invest in advanced wireless security solutions. This trend is likely to drive growth in the wireless lan-security market as firms seek to mitigate risks associated with data breaches and unauthorized access. The urgency to safeguard networks against evolving threats is a primary driver, compelling businesses to adopt comprehensive security frameworks that include encryption, authentication, and intrusion detection systems.

Shift to Remote Work

The transition to remote work in Spain has catalyzed a surge in demand for wireless security solutions. As organizations adapt to flexible work arrangements, the need to secure remote access to corporate networks becomes paramount. This shift has led to an increased focus on securing wireless connections, as employees access sensitive information from various locations. The wireless lan-security market is likely to benefit from this trend, with businesses investing in Virtual Private Networks (VPNs), secure Wi-Fi access points, and endpoint security solutions. In 2025, it is projected that remote work will account for approximately 30% of the workforce in Spain, further driving the need for enhanced wireless security measures to protect against potential vulnerabilities.

Technological Advancements

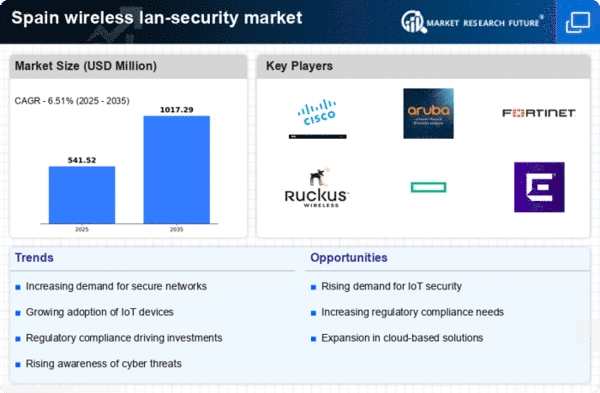

Technological advancements in wireless security technologies are propelling the growth of the wireless lan-security market in Spain. Innovations such as next-generation firewalls, machine learning algorithms, and advanced encryption methods are enhancing the effectiveness of security solutions. These advancements enable organizations to better detect and respond to threats in real-time, thereby improving overall network security. The market is expected to witness a compound annual growth rate (CAGR) of around 12% from 2025 to 2030, driven by the adoption of these cutting-edge technologies. As businesses seek to leverage the latest innovations to safeguard their networks, the demand for sophisticated wireless security solutions is likely to increase significantly.

Regulatory Compliance Pressure

In Spain, compliance with stringent data protection regulations, such as the General Data Protection Regulation (GDPR), is a significant driver for the wireless lan-security market. Organizations are mandated to implement adequate security measures to protect personal data, leading to increased investments in wireless security solutions. Non-compliance can result in hefty fines, reaching up to €20 million or 4% of annual global turnover, whichever is higher. This regulatory landscape compels businesses to prioritize security, thereby fostering growth in the wireless lan-security market. As companies strive to align with legal requirements, the demand for effective security protocols and technologies is expected to rise, further enhancing the market's expansion.

Increased Awareness of Data Privacy

Growing awareness of data privacy issues among consumers and businesses in Spain is influencing the wireless lan-security market. As individuals become more conscious of their personal data rights, organizations are compelled to enhance their security measures to build trust and maintain customer loyalty. This heightened awareness is driving companies to invest in wireless security solutions that ensure data protection and compliance with privacy regulations. In 2025, it is anticipated that 70% of Spanish consumers will prioritize data privacy when choosing service providers, prompting businesses to adopt robust wireless security measures. Consequently, the wireless lan-security market is expected to expand as organizations strive to meet consumer expectations and regulatory demands.