Rising Healthcare Expenditure

Spain's rising healthcare expenditure is another significant driver impacting the wheelchair market. The Spanish government has been increasing its investment in healthcare services, which includes funding for mobility aids. In recent years, healthcare spending has risen by approximately 5% annually, reflecting a commitment to improving the quality of life for individuals with disabilities and mobility impairments. This increase in funding allows for better access to wheelchairs and related services, thereby stimulating market growth. Additionally, as healthcare policies evolve to prioritize patient-centered care, the wheelchair market is likely to benefit from enhanced support for individuals requiring mobility assistance. The focus on improving healthcare outcomes may lead to increased adoption of advanced wheelchair technologies.

Rising Incidence of Chronic Diseases

The rising incidence of chronic diseases in Spain is a significant factor influencing the wheelchair market. Conditions such as diabetes, cardiovascular diseases, and neurological disorders are becoming more prevalent, leading to an increased need for mobility aids. According to recent health statistics, approximately 25% of the Spanish population is affected by chronic illnesses, many of which can result in mobility impairments. This trend suggests that the wheelchair market will likely see sustained growth as more individuals seek mobility solutions to enhance their quality of life. Additionally, healthcare providers are increasingly recognizing the importance of mobility aids in patient care, further driving demand for wheelchairs that cater to various health conditions.

Increased Awareness of Disability Rights

The growing awareness of disability rights in Spain is a pivotal driver for the wheelchair market. Advocacy groups and non-governmental organizations have been actively promoting the rights of individuals with disabilities, leading to greater public consciousness regarding accessibility and mobility issues. This heightened awareness has resulted in increased demand for wheelchairs that meet specific needs and preferences. Furthermore, the Spanish government has implemented policies aimed at improving accessibility in public spaces, which indirectly boosts the wheelchair market. As society becomes more inclusive, the expectation for high-quality mobility solutions rises, prompting manufacturers to innovate and diversify their product offerings to cater to a broader audience.

Technological Innovations in Mobility Devices

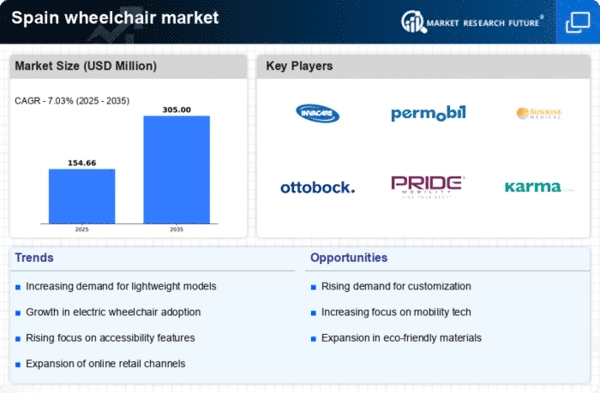

Technological innovations are transforming the wheelchair market in Spain. The introduction of smart wheelchairs equipped with advanced features such as navigation systems, automated controls, and connectivity options is reshaping consumer expectations. These innovations not only enhance user experience but also improve safety and accessibility. The market for electric wheelchairs, which accounted for approximately 30% of total wheelchair sales in Spain in 2025, is particularly influenced by these advancements. As consumers become more aware of the benefits of technology in mobility devices, the demand for high-tech wheelchairs is expected to rise. This trend indicates that manufacturers must continue to invest in research and development to remain competitive in the evolving wheelchair market.

Aging Population and Demand for Mobility Solutions

The aging population in Spain is a crucial driver for the wheelchair market. As the demographic shifts, the number of individuals requiring mobility assistance is increasing. By 2025, it is estimated that over 20% of the Spanish population will be aged 65 and older, leading to a heightened demand for wheelchairs. This demographic trend suggests that the wheelchair market will experience significant growth, as older adults often face mobility challenges. Furthermore, the increasing prevalence of age-related conditions such as arthritis and osteoporosis further fuels the need for effective mobility solutions. The wheelchair market is likely to expand as manufacturers innovate to meet the specific needs of this demographic, offering products that enhance comfort and usability for elderly users.