Advancements in Mobile Technology

Technological advancements are a key driver of the virtual mobile-infrastructure market in Spain. The rapid evolution of mobile technologies, including 5G connectivity and edge computing, is enabling organizations to enhance their mobile infrastructure capabilities. With 5G expected to cover over 80% of urban areas in Spain by 2026, businesses are increasingly investing in virtual mobile solutions to leverage faster data transmission and improved performance. This technological shift is likely to transform how organizations operate, making the virtual mobile-infrastructure market a focal point for innovation and growth in the coming years.

Rising Demand for Remote Work Solutions

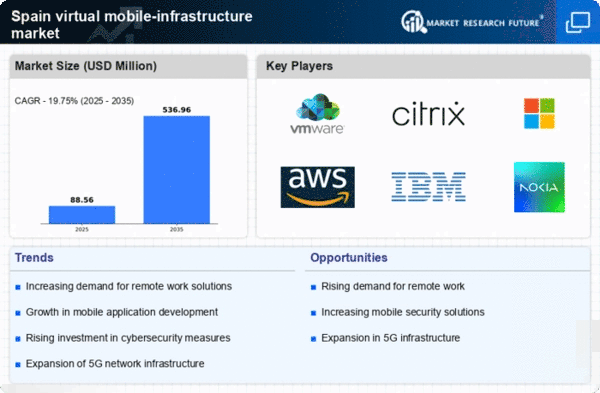

the market is experiencing a notable surge in demand for remote work solutions. As organizations increasingly adopt flexible work arrangements, the need for robust mobile infrastructure becomes paramount. This shift is evidenced by a reported 30% increase in remote work adoption among Spanish companies over the past year. Consequently, businesses are investing in virtual mobile-infrastructure to ensure seamless connectivity and collaboration among remote teams. This trend is likely to continue, as companies recognize the benefits of enhanced productivity and employee satisfaction associated with effective remote work solutions. The virtual mobile-infrastructure market is thus positioned to grow significantly, driven by this evolving work culture.

Growing Need for Cost-Effective Solutions

The virtual mobile-infrastructure market in Spain is witnessing a growing need for cost-effective solutions among businesses. As economic pressures mount, organizations are seeking ways to optimize operational costs while maintaining efficiency. The adoption of virtual mobile infrastructure allows companies to reduce hardware expenses and streamline IT management. Reports indicate that businesses can save up to 40% on IT costs by transitioning to virtual mobile solutions. This financial incentive is driving the demand for virtual mobile-infrastructure, as organizations aim to balance budget constraints with the need for modern technological capabilities.

Increased Focus on Data Privacy Regulations

the market is significantly influenced by the heightened focus on data privacy regulations. With the implementation of stringent data protection laws, such as the General Data Protection Regulation (GDPR), organizations are compelled to adopt secure mobile infrastructure solutions. This regulatory environment has led to a 25% increase in investments in security features within mobile infrastructures over the past year. Companies are prioritizing compliance to avoid hefty fines and reputational damage, thereby driving demand for virtual mobile-infrastructure solutions that ensure data security and privacy. This trend is likely to persist as regulatory scrutiny intensifies.

Government Initiatives Supporting Digital Transformation

In Spain, government initiatives aimed at promoting digital transformation are playing a crucial role in the growth of the virtual mobile-infrastructure market. The Spanish government has allocated approximately €1 billion to support digitalization efforts across various sectors. This funding is intended to enhance technological infrastructure, thereby facilitating the adoption of virtual mobile solutions. As public and private sectors align with these initiatives, the demand for advanced mobile infrastructure is expected to rise. The virtual mobile-infrastructure market stands to benefit from these efforts, as organizations seek to leverage government support to modernize their operations and improve efficiency.