Increased Pet Ownership

The Spain veterinary equipment disposables market is significantly influenced by the rising trend of pet ownership across the country. As more households adopt pets, the need for veterinary services and associated disposable equipment has surged. Recent statistics indicate that over 50% of Spanish households own at least one pet, leading to a higher frequency of veterinary visits. This increase in pet ownership correlates with a heightened demand for disposable items such as surgical drapes, needles, and examination gloves. Consequently, veterinary clinics are investing more in disposable equipment to ensure efficient and hygienic care for their patients, further propelling the growth of the market.

Rising Demand for Preventive Care

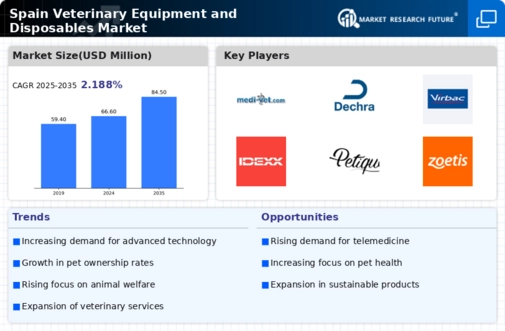

The Spain veterinary equipment disposables market is experiencing a notable increase in demand for preventive care solutions. Pet owners are becoming increasingly aware of the importance of regular health check-ups and vaccinations for their animals. This trend is reflected in the growing sales of disposable syringes, gloves, and other single-use items that facilitate safe and hygienic veterinary practices. According to recent data, the market for veterinary disposables in Spain is projected to grow at a compound annual growth rate of approximately 5% over the next five years. This growth is driven by the rising number of pet owners who prioritize preventive healthcare, thereby boosting the demand for disposable veterinary equipment.

Regulatory Compliance and Standards

The Spain veterinary equipment disposables market is heavily influenced by stringent regulatory compliance and standards set by health authorities. Veterinary clinics are required to adhere to specific guidelines regarding hygiene and safety, which necessitates the use of disposable equipment to minimize the risk of cross-contamination. The Spanish Agency for Medicines and Health Products has established regulations that promote the use of single-use items in veterinary practices. This regulatory environment not only ensures the safety of animals but also drives the demand for high-quality disposable products. As compliance becomes increasingly critical, veterinary clinics are likely to invest more in disposables, further fueling market growth.

Focus on Environmental Sustainability

The Spain veterinary equipment disposables market is witnessing a shift towards environmentally sustainable practices. As awareness of environmental issues grows, veterinary clinics are increasingly seeking eco-friendly disposable products. This trend is prompting manufacturers to innovate and develop biodegradable and recyclable veterinary disposables. The Spanish government has also introduced policies aimed at reducing plastic waste, which encourages the adoption of sustainable alternatives in veterinary practices. This focus on sustainability not only aligns with consumer preferences but also positions veterinary clinics as responsible entities in the community, potentially enhancing their reputation and client loyalty.

Technological Integration in Veterinary Practices

The Spain veterinary equipment disposables market is being transformed by the integration of advanced technologies in veterinary practices. Innovations such as telemedicine and digital health records are becoming commonplace, leading to more efficient operations in veterinary clinics. This technological shift necessitates the use of specialized disposable equipment, such as digital thermometers and single-use diagnostic tools, to ensure accurate and safe procedures. As veterinary practices adopt these technologies, the demand for high-quality disposable equipment is likely to increase, thereby driving growth in the market. The trend suggests a future where technology and disposables work hand in hand to enhance veterinary care.