Growing Awareness and Education

The rising awareness of vascular health issues among the Spanish population is significantly impacting the vascular embolization market. Educational campaigns and initiatives by healthcare organizations are informing patients about the risks associated with vascular diseases and the benefits of embolization procedures. This increased awareness is likely to lead to earlier diagnosis and treatment, thereby expanding the patient base for embolization therapies. The vascular embolization market is expected to see a positive shift as more individuals seek out these procedures. Surveys indicate that nearly 60% of the population is now aware of vascular conditions, which is a substantial increase compared to previous years. This trend suggests a growing demand for embolization services, potentially leading to a market growth rate of around 7% annually.

Increased Healthcare Expenditure

Spain's rising healthcare expenditure is a crucial factor driving the vascular embolization market. The government and private sectors are investing more in healthcare infrastructure, which includes advanced treatment modalities for vascular conditions. This increase in funding allows for better access to innovative embolization techniques and devices. Reports indicate that healthcare spending in Spain is expected to reach approximately €200 billion by 2026, reflecting a commitment to improving patient care. The vascular embolization market stands to gain from this trend, as more resources are allocated to specialized treatments. Enhanced funding not only facilitates the procurement of advanced technologies but also supports training for healthcare professionals, ensuring that patients receive high-quality care.

Supportive Regulatory Environment

The regulatory landscape in Spain is becoming increasingly favorable for the vascular embolization market. Authorities are streamlining the approval processes for new medical devices and procedures, which encourages innovation and market entry. Recent initiatives aimed at expediting the review of embolization technologies are likely to enhance competition and improve patient access to cutting-edge treatments. The vascular embolization market is poised to benefit from these regulatory changes, as they facilitate quicker adoption of new therapies. With a supportive framework in place, companies are more inclined to invest in research and development, potentially leading to a broader range of embolization options for healthcare providers. This regulatory support may contribute to an estimated market growth of 6% over the next few years.

Advancements in Medical Technology

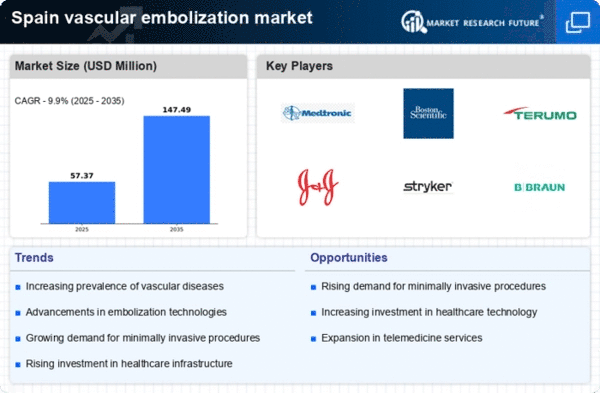

Technological innovations in the field of vascular embolization are significantly influencing the market in Spain. The introduction of minimally invasive techniques and advanced embolic agents has improved patient outcomes and reduced recovery times. For instance, the development of new materials and delivery systems has enhanced the precision of embolization procedures. The vascular embolization market is witnessing a surge in the adoption of these technologies, which are often associated with lower complication rates. As hospitals and clinics invest in state-of-the-art equipment, the market is projected to grow, with estimates suggesting a valuation of over €500 million by 2027. This technological evolution not only enhances procedural efficacy but also attracts more patients seeking less invasive treatment options.

Rising Incidence of Vascular Diseases

The increasing prevalence of vascular diseases in Spain is a primary driver for the vascular embolization market. Conditions such as aneurysms, arteriovenous malformations, and peripheral artery disease are becoming more common, leading to a heightened demand for effective treatment options. According to recent health statistics, vascular diseases account for a significant portion of morbidity and mortality in the country. This trend is likely to propel the market forward, as healthcare providers seek innovative solutions to manage these conditions. The vascular embolization market is expected to benefit from this growing patient population, with an anticipated growth rate of approximately 8% annually over the next few years. As awareness of these diseases increases, so does the need for advanced embolization techniques, further driving market expansion.