Increased Awareness and Education

The rising awareness of TMJ disorders among the Spanish population is driving demand for treatment options, including implants. Educational campaigns by healthcare providers and organizations are informing patients about the symptoms and potential treatments for TMJ disorders. This increased knowledge encourages individuals to seek medical advice and explore surgical options when conservative treatments fail. As more patients become informed about the benefits of tmj implants, the market is likely to see a corresponding increase in demand. The tmj implants market is thus positioned to expand, as healthcare professionals respond to the growing need for effective solutions to manage TMJ disorders.

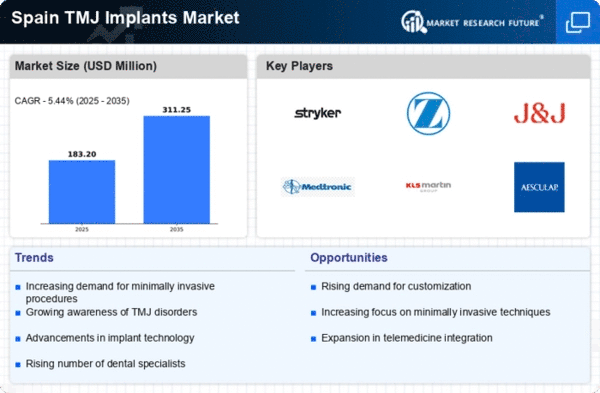

Advancements in Implant Technology

Technological innovations in implant design and materials are significantly influencing the tmj implants market. Recent advancements have led to the development of biocompatible materials that enhance the longevity and effectiveness of implants. For instance, the introduction of 3D printing technology allows for customized implants tailored to individual patient anatomies, improving surgical outcomes. Furthermore, minimally invasive techniques are gaining traction, reducing recovery times and enhancing patient satisfaction. As these technologies become more prevalent, the tmj implants market is likely to experience a surge in adoption rates, with healthcare professionals increasingly opting for advanced solutions that promise better results and lower complication rates.

Rising Prevalence of TMJ Disorders

The increasing incidence of temporomandibular joint (TMJ) disorders in Spain is a primary driver for the tmj implants market. Factors such as stress, poor posture, and dental issues contribute to this rise. Recent studies indicate that approximately 10-15% of the population experiences TMJ-related symptoms, leading to a growing demand for effective treatment options. As awareness of these disorders increases, patients are more likely to seek surgical interventions, including implants. This trend is expected to propel the market forward, as healthcare providers aim to address the needs of this expanding patient demographic. Consequently, the tmj implants market is poised for growth, with an anticipated increase in procedures and product innovations to cater to the rising demand.

Aging Population and Associated Health Issues

Spain's aging population is contributing to the growth of the tmj implants market. As individuals age, they often experience a higher incidence of dental issues and joint disorders, including TMJ dysfunction. This demographic shift is leading to an increased demand for surgical interventions, as older patients seek relief from chronic pain and improved quality of life. The tmj implants market is likely to see a rise in procedures aimed at this demographic, as healthcare providers adapt to the needs of an aging population. Furthermore, the combination of age-related health issues and the desire for effective treatment options positions the market for sustained growth in the coming years.

Growing Investment in Healthcare Infrastructure

Spain's commitment to enhancing its healthcare infrastructure is a crucial driver for the tmj implants market. The government has been increasing its healthcare budget, focusing on improving surgical facilities and access to advanced medical technologies. This investment is expected to facilitate the adoption of innovative treatment options, including tmj implants. As hospitals and clinics upgrade their capabilities, the availability of specialized care for TMJ disorders will likely improve, leading to higher patient volumes. Consequently, the tmj implants market stands to benefit from this trend, as enhanced infrastructure supports the growth of surgical procedures and the introduction of new implant technologies.