Focus on Patient Safety

Patient safety remains a critical concern within the healthcare sector in Spain, driving the surgical blades market. The emphasis on reducing surgical complications and enhancing patient outcomes has led to a preference for high-quality, reliable surgical instruments. Hospitals are increasingly investing in advanced surgical blades that minimize the risk of infection and ensure precision during procedures. This focus on safety is reflected in the surgical blades market, where manufacturers are innovating to produce blades that meet stringent safety standards. As healthcare providers prioritize patient welfare, the demand for superior surgical blades is expected to rise, further propelling market growth.

Increasing Surgical Procedures

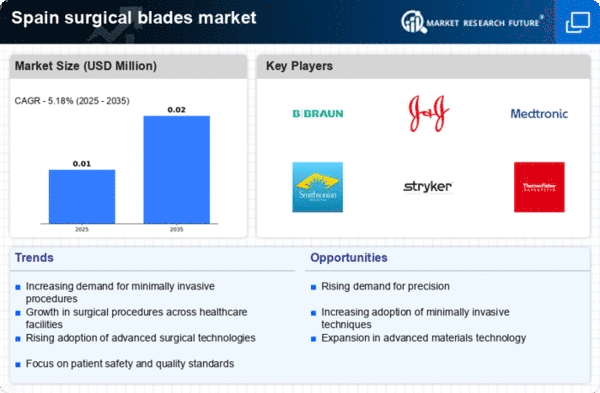

The rising number of surgical procedures in Spain is a primary driver for the surgical blades market. As healthcare facilities expand and the population ages, the demand for surgical interventions is likely to increase. According to recent data, the number of surgeries performed annually in Spain has shown a steady growth of approximately 5% over the past few years. This trend suggests that healthcare providers are increasingly relying on surgical blades for various procedures, including minimally invasive surgeries. The surgical blades market is thus positioned to benefit from this upward trajectory, as hospitals and clinics seek to equip themselves with high-quality surgical instruments to meet the growing demand.

Growth of Ambulatory Surgical Centers

The proliferation of ambulatory surgical centers (ASCs) in Spain is significantly impacting the surgical blades market. These facilities, which offer outpatient surgical services, are becoming increasingly popular due to their efficiency and cost-effectiveness. The surgical blades market is likely to see a surge in demand as ASCs require a steady supply of surgical instruments to accommodate the growing number of procedures performed. Recent statistics indicate that ASCs in Spain have experienced a growth rate of around 7% annually, suggesting a robust market for surgical blades as these centers expand their services and capabilities.

Regulatory Support for Medical Devices

Regulatory frameworks in Spain are increasingly supportive of the medical device sector, including the surgical blades market. The Spanish Agency of Medicines and Medical Devices (AEMPS) plays a crucial role in ensuring that surgical instruments meet safety and efficacy standards. This regulatory environment fosters innovation and encourages manufacturers to develop high-quality surgical blades. As compliance with regulations becomes more streamlined, the surgical blades market is likely to benefit from increased investment and product development. The assurance of safety and quality in surgical instruments is expected to enhance market growth, as healthcare providers seek reliable solutions for their surgical needs.

Technological Innovations in Surgical Instruments

Technological advancements in surgical instruments are reshaping the surgical blades market. Innovations such as improved blade materials and designs enhance performance and durability, making them more appealing to healthcare providers. The surgical blades market is witnessing a trend towards blades that offer better cutting efficiency and reduced tissue trauma. As hospitals and surgical centers in Spain adopt these advanced technologies, the demand for innovative surgical blades is expected to rise. This shift towards high-tech surgical instruments indicates a potential for growth in the market, as healthcare professionals seek to improve surgical outcomes through superior tools.